When you do something, do it right.

If you are a business owner in an SME or Startup, you probably have to manage its finance to some extent. It is also likely you already have a system in place for paying your vendors.

There are examples of several businesses crashing soon after take-off due to unoptimized cash flow.

Using vendor payment systems hence becomes important. These systems re-iterate the brand’s credibility and also help in managing accounts.

If you don’t have a vendor payment system yet, now is the time.

This is because of two simple reasons:-

a) you need to optimize your cash flow

b) you need to maintain good vendor ties for quality products to be delivered.

Table of Contents

- Why Is Vendor Payments Management Important?

- Challenges While Using Vendor Payment System

- #1 Schedule Payments in Advance Using Your Vendor Payment System

- #2 Enhance Your Relationship With the Best Vendors

- #3 Automate the AP Process and Organize Your Things

- #4 Daily Reconciliation

- #5 E-payments With ACH

- #6 AP Processing and Reporting Should Be Centralized

- #7 Systemize Your Financial Operations – Accounting and Reporting

- Your Best Option – Karbon Payout

Why Is Vendor Payments Management Important?

When you start with managing 10-15 vendor payments, it is fine.

Now, imagine scaling up to 50 or more as your business grows.

100’s of bulk transactions will take place.

Every. Single. Day.

Here’s where the need for a vendor payment system cannot be overlooked. Accounts payable, commonly known as vendor payment will not get mixed up with a simple management strategy under the vendor payment system.

Challenges While Using Vendor Payment System

The vendor payment process should be a part of every business’s accounts payable process. The purchase-to-pay cycle also ends with this as one of its final steps.

The process is simple: The accounts payable department within the company receives the vendor invoice, verifies it, and then routes it for approval.

Post approval, the respective payment is received by the vendor. While this process sounds simple it can be a real nightmare if handled poorly.

The main challenges are: –

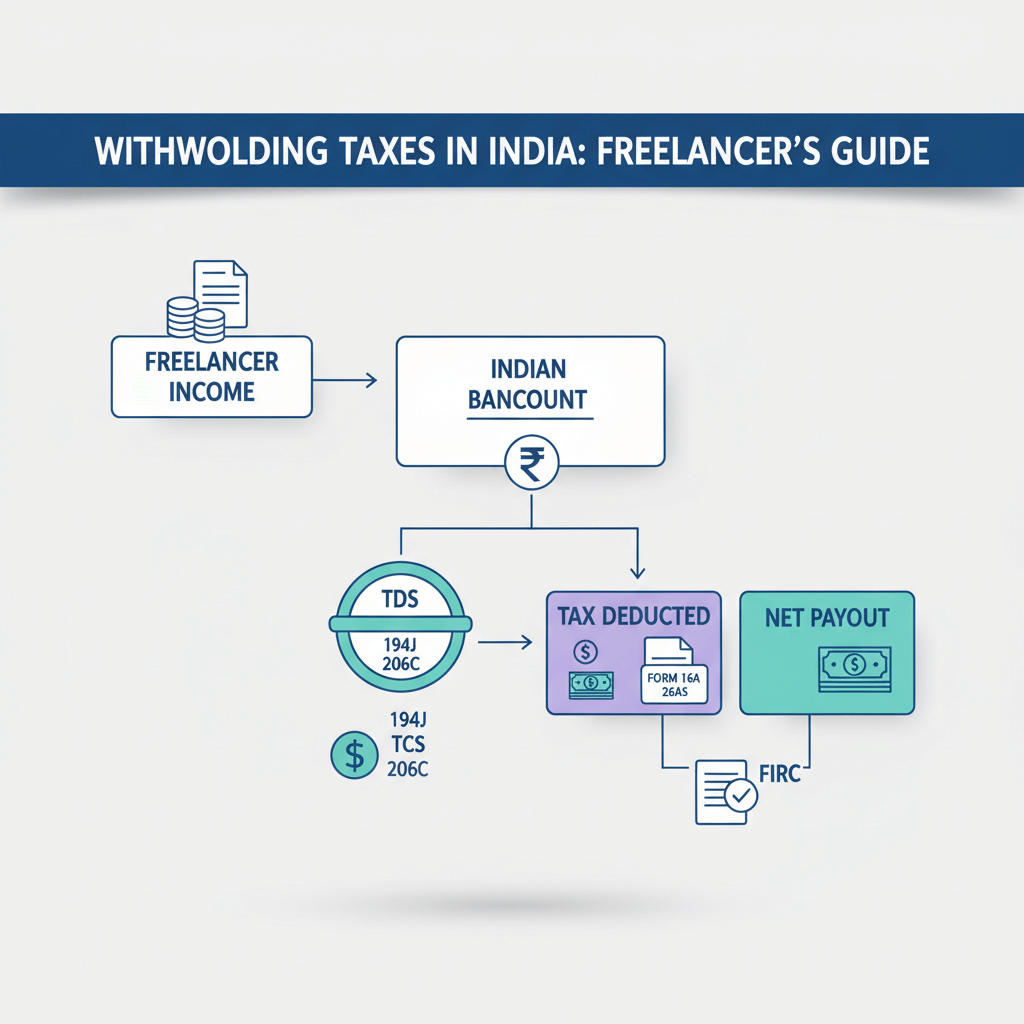

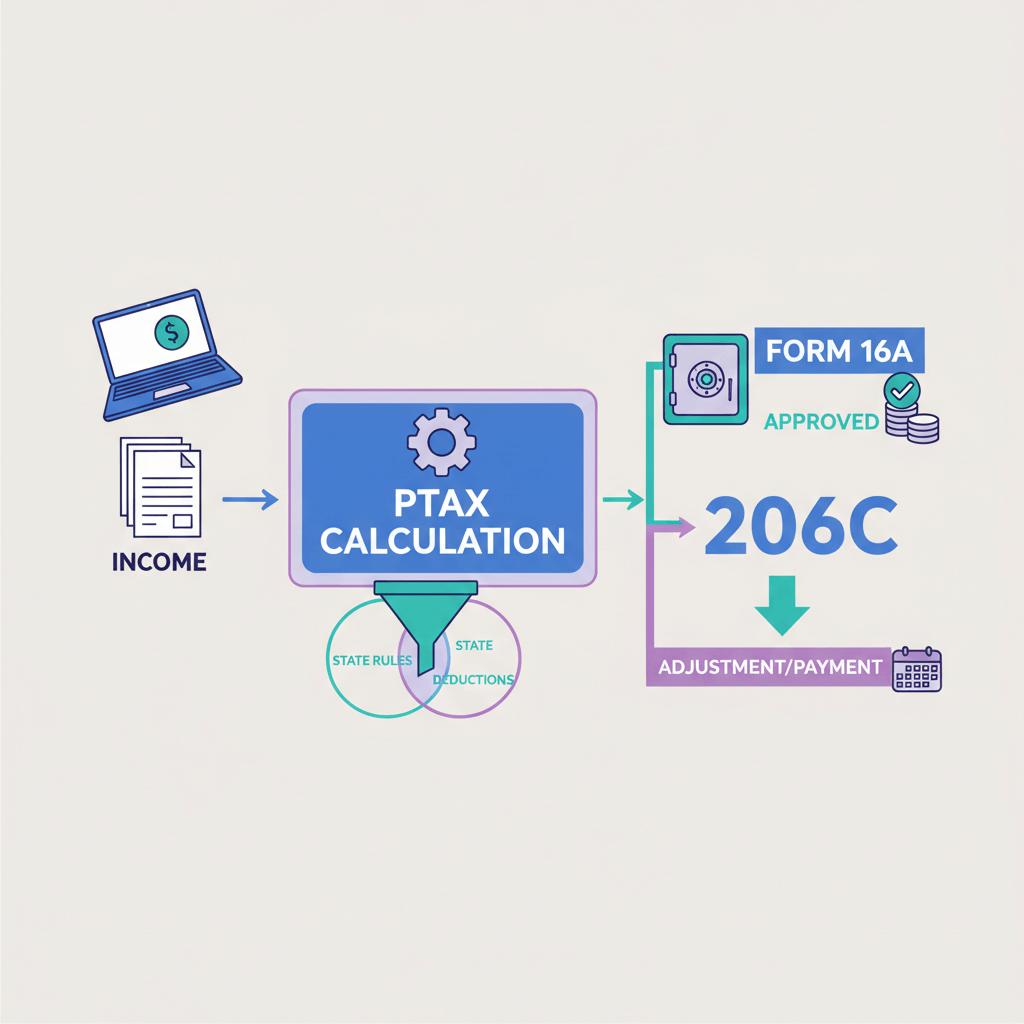

- Wrong calculations input for TDS deductions and GST

- Slow reconciliation process with outdated Vendor payment software.

- Error in data input

- Choosing the wrong system with an unfriendly user interface

- Security issues while using unverified vendor payment portals that can leak sensitive information

So to navigate through these challenges, down below are the top 7 tips our experts at Karbon Card recommend.

#1 Schedule Payments in Advance Using Your Vendor Payment System

As a business owner, you will not have to take out a sizeable chunk of your precious time in handling the payment process.

And as we all know, automation makes everybody’s life simple. So scheduling recurring payments for your trusted vendors will ensure your top vendors receive the attention and payments they deserve.

Choosing software that gives freedom to vendors to add themselves as beneficiaries to the system will be a bonus!

#2 Enhance Your Relationship With the Best Vendors

Covid lockdowns have made the situation worse. Each lockdown brings anxiety to vendors about delayed payments.

So focus on accounts payable processing while using a vendor payment system.

Make a genuine effort to stand out from the crowd by paying your vendors on time. This will open doors to good communication and enhanced trust between you and your vendors.

They will notice it. They will remember it.

#3 Automate the AP Process and Organize Your Things

Still, stuck with the manual accounts payable process? Which era are you living in?

Organizations that automate their accounts payable (AP) processes end up processing vendor invoices faster leaving you far behind in the race

Company efficiency and exposure can be increased by implementing a strong automation process. So automating the accounts payable process cannot be emphasized enough.

This ultimately works in favor of the company in terms of saving costs and increasing pay cycle efficiency.

#4 Daily Reconciliation

This is highly important if you want to optimize your cash flow. Make a good habit of getting your accounts updated every single day with an automated payment process.

#5 E-payments With ACH

Nowadays there are e-payment solutions such as the Automated Clearing House (ACH) that end up reducing the company’s overhead costs. It also improves the accuracy of your books by initiating auto-debit and credit transactions with your vendors.

#6 AP Processing and Reporting Should Be Centralized

If you own a large organization, this will be more relevant to you. By centralizing your AP processes, you can streamline workflows and reinforce superior book-keeping practices.

Above everything, this also lets your team achieve more, even with time and resource crunch. This ultimately promotes a lean implementation and keeps your vendor payment system streamlined.

#7 Systemize Your Financial Operations – Accounting and Reporting

Before you think of managing your accounts payable, first ensure your accounts and reports are up to date.

You also need to ensure that your accounts payable balances reflect accurately in your financial statements.

Without this, you will definitely be blindsided by the number of transactions and timelines for vendor payment.

To incorporate the above you needn’t look anywhere else.

Karbon card has built an efficient vendor payment system through a high degree of Accounts Payable automation called Karbon Payout.

Your Best Option – Karbon Payout

Our clients make use of Karbon Payout to automate the AP processes, make vendor payments, and streamline beneficiary management.

Features:-

1. One Size Fits All:

Schedule your payments, all in a single click! Karbon Payout enables you to upload all details in one place and schedule your payments according to your convenience. You enjoy the benefit of cash flow optimization while your vendor enjoys the benefit of timely payments.

2. Automated Payout Links:

Add beneficiaries automatically using Payout links. Vendors can add themselves as beneficiaries in your vendor payment system, clearly indicating that you are serious about timely payments and are willing to adopt smart tech for the same.

3. Informational and Concise:

Don’t get confused with the paradox.

Details of all transactions will be at your fingertips in the most concise way.

- · Vendor name

- · Vendor code

- · Contract

- · Finance report

- · Total amount paid

- · Amount due

- · Amount settled

- · Payment mode

- · Vendor payment details

4. High Degree in AP Automation:

Provides the ultimate vendor satisfaction. You will no longer have to risk losing your top vendor (and ultimately the quality of your top product) as long as your vendor stays satisfied with your payment timelines.

5. Frequent Reconciliation Enabled:

This makes it extremely easy for conducting daily, weekly and monthly audits concerning your payments. Helps you prioritize optimization of cash flow to keep finances in order.

6. Send Payments 24×7:

Karbon Payout is NACH-enabled. This means that you can carry out all financial operations 24×7, 365 days. It works even during bank holidays.

7. AI-Powered Payment mode:

Be it RTGS, NEFT, or IMPS, our smart vendor payment system selects the best payment channel for you, thanks to advanced analytics and intelligent automation.

8. User-Friendly Interface:

You can spend less time worrying about payment glitches and more time focusing on business growth with a single dashboard.