Karbon Business makes it effortless for Indian businesses to collect payments from clients across the globe

100+ Countries Supported

Find out what makes Karbon FX the smart choice for cross-border payments

Competitive Rates

Karbon offers the best rates for inward remittance with 0% markup, providing you the best value for your inward remittances.

Transparent Fee Structure

Our transparent fees show the exact INR amount you’ll receive, with no hidden charges and the best exchange rates.

Fast Onboarding & Settlement

Receive international payments in India within 24–48 hours. Get started in 10 minutes—submit your first invoice and start accepting payments online.

24/7 Support

We're just a message away. Get real-time assistance for all your payment needs, anytime, anywhere.

Competitive Rates

Karbon offers the best rates for inward remittance with 0% markup, providing you the best value for your inward remittances.

Transparent Fee Structure

Our transparent fees show the exact INR amount you’ll receive, with no hidden charges and the best exchange rates.

Fast Onboarding & Settlement

Receive international payments in India within 24–48 hours. Get started in 10 minutes—submit your first invoice and start accepting payments online.

24/7 Support

We're just a message away. Get real-time assistance for all your payment needs, anytime, anywhere.

Here are some of the features that set Karbon apart from traditional foreign remittance solutions.

Karbon

Others

Forex Markup

0%

>3%

Customer Support

24 Hrs

Via Email

Chargeback or Dispute

No

Yes

Funds Block

No

Yes

Transaction Fee

1%

>3%

Transaction fee: 1%

0% Forex markup

24hrs Customer Support

No Chargeback/Disputes

No Funds block

Transaction fee: >3%

Minimum 3% Forex markup

24hrs customer support

Chargeback/Disputes

Funds block

See how we help companies save time, money, and hassle on every international transaction.

See how we help companies save time, money, and hassle on every international transaction.

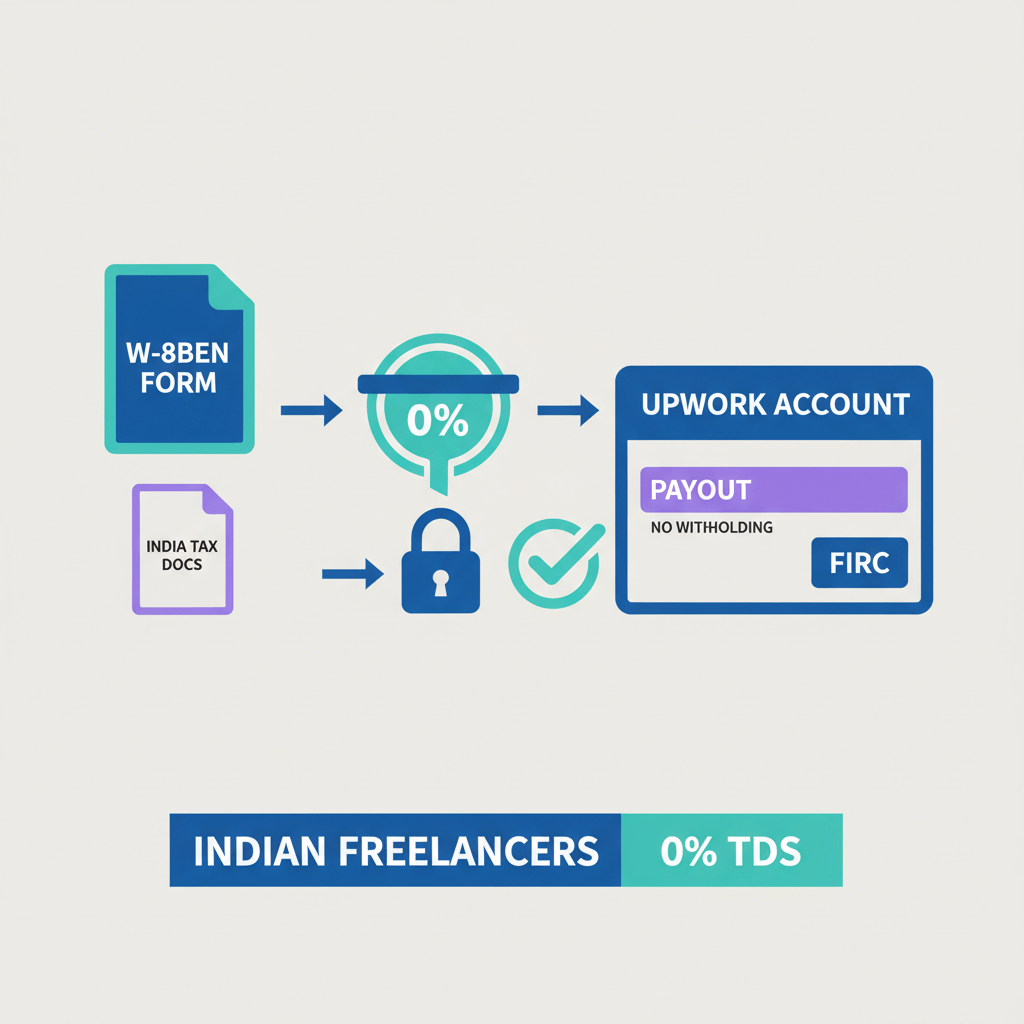

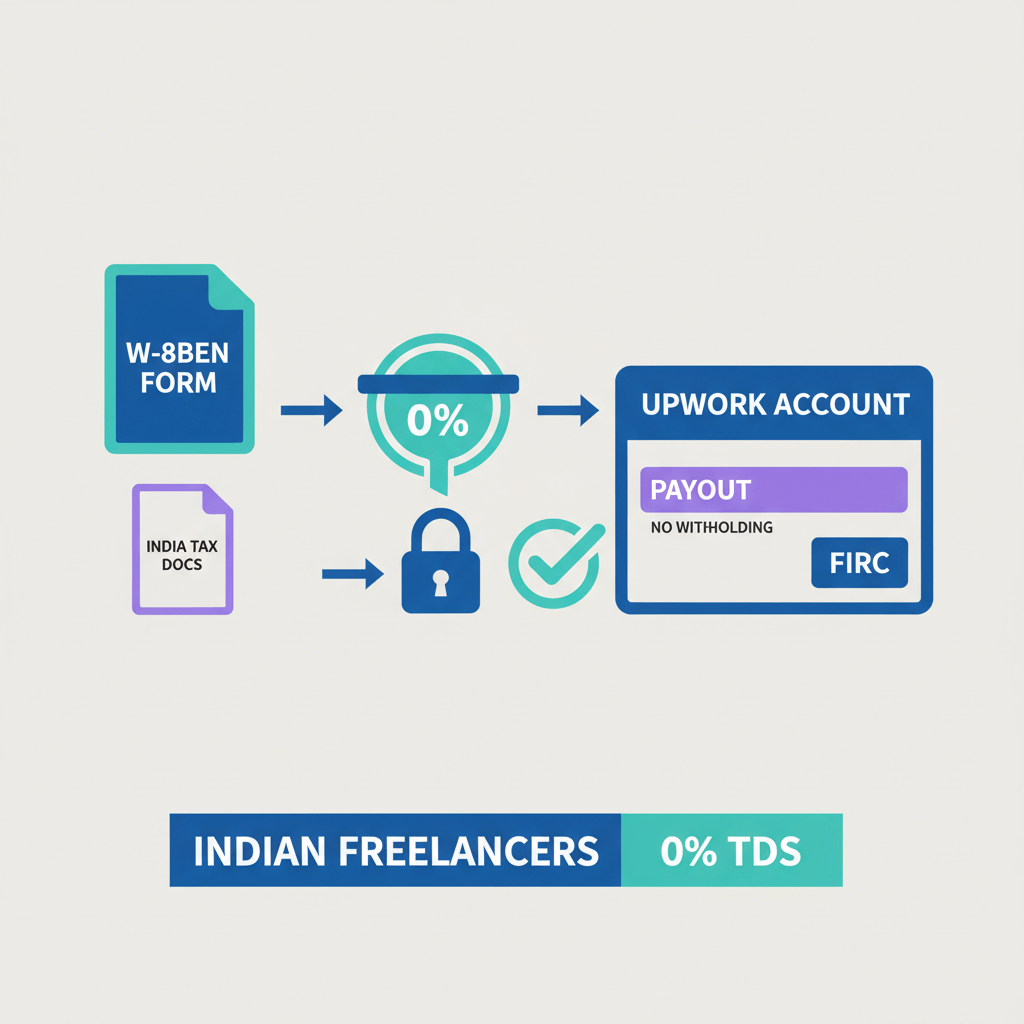

W-8BEN for Indian Freelancers: Upwork Guide to 0% Withholding

Swati Saraf

February 17, 2026

W-8BEN for Indian Freelancers: Upwork Guide to 0% Withholding

Swati Saraf

How to receive international payments in an Indian bank account?

To receive international payments in your Indian bank account, simply share the details of your international virtual account with the sender. This will include details like your virtual bank account number, IFSC code, and SWIFT/BIC codes. With our Karbon Forex dashboard, you can streamline this process and perform the entire transfer online.

How to accept international payments in India as a freelancer?

As a freelancer, you can easily accept international payments using Karbon Forex. It offers lower fees and faster transfers compared to traditional methods, helping you focus on your work without worrying about payment delays. Simply share your invoice with us and we will ensure the payment arrives in your bank account.

Is Karbon Forex a payment gateway? Or does it specialize in SWIFT wire transfers to accept international payments in India?

Karbon Forex is not a payment gateway. It is more of a SWIFT wire transfer provider that helps Indian businesses accept international payments pretty hassle-free. Payment gateways are generally suited tp online card payments or digital transactions, whereas Karbon Forex handles international wire transfers. These are more effective for businesses where there are very large volumes of international payments involved or businesses catering to global clients who prefer bank-to-bank transfers over online gateways.

The greatest advantage of using Karbon Forex is its lower forex cost for inward remittances. Most payment gateways have a higher charge as it involves an intermediary cost and multi-layer processing, while the SWIFT wire transfer is less expensive. Business-to-business firms using Karbon Forex get direct transfers with fewer delays, fee transparency, and a reduction in foreign exchange margins that ultimately means a greater profit. This makes Karbon Forex a very good option for companies looking for cost-effective, secure and reliable options for international payments.

What is the best way to accept international payments?

Out of many options for receiving international payments, a global virtual bank account is considered to be the best. This is because a virtual bank account allows you to receive payments in the currency of the payment transfer, using (usually free) domestic methods of funds transfer. To learn more about how virtual bank accounts work and why they are considered one of the best ways to accept international payments.

Read this article.

How Much Does It Cost to Accept International Payments in India Through Karbon Forex?

Our transparent and competitive pricing structure allows clients to accept international payments without hidden fees. We offer 0% mark-up on currency conversions, using live exchange rates, while our payment processing fee is upto 1%. This make Karbon significantly more affordable than traditional banks or payment processors.

Karbon Forex also saves the businesses from unwanted banking overheads, thereby making sure that businesses get a bigger share of their payments. Simplifying the cost structure and providing clarity on the applied forex rates helps Karbon make international transactions less uncertain for businesses. This low-margin model reduces operational costs and cash flow management to make it the preferred choice for Indian businesses engaged in global trade.

Does the Forex Fee include GST?

No, the forex fee charged by Karbon Forex does not include GST or any other kind of tax. In general, GST is charged only on the processing fees and not the principal amount. It will be applied individually after considering the different regulations from the government. Clients will be made aware of the applicable taxes before payment processing. In this way, there is total transparency; hence every charge is accounted for before the acceptance of international payments through a business.

Karbon is committed to transparency, so there are no hidden charges or unexpected deductions. Businesses can rely on a straightforward cost structure that simplifies the financial planning process. Keeping the forex fee exclusive of GST ensures Karbon complies with Indian tax regulations while offering businesses a clear and accurate breakdown of costs.

What Documents Are Needed to Accept International Payments in India with Karbon Forex?

Karbon Forex makes the process of onboarding clients easy and requires only basic documents to accept international payments in India. No extra paperwork is required for any individual transaction except for onboarding purposes. Here's the list of required documents:

For Onboarding:

Company Name / Legal Name: The registered name of your business.

Doing Business As (DBA) / Brand Name: For sole proprietors, the brand name under which they operate.

Company Website: A functional website showcasing your business and services.

Product or Service Description: Details about the products or services offered by your business.

Company Email: An official email address associated with your company.

Permanent Address: The registered office address of your business.

Bank Account Details: Information about the business bank account for receiving international payments.

Documents Required for Transactions:

Owner's PAN Card & Aadhar Card: For identification of the owner of the business.

GST Certificate: In case the company is registered under GST, this is a must.

Company PAN: For checking the tax registration of the company.

Karbon Forex has an onboarding process that is simple and minimalistic, keeping in mind the regulatory requirements. After the onboarding process, businesses can carry out international transactions without any more paperwork.

What is the transaction time involved in accepting international payments in India through Karbon Forex?

Fast transaction processing is one of the key attributes that make Karbon Forexstand out, making it very possible to acquire funds with short turnaround time for businesses.

For the very first post-onboarding transaction, Karbon Forex will finish processing the payment within less than 24-48 working hours. This can be facilitated through the streamlined onboarding process and advanced SWIFT infrastructure that facilitates fast cross-border payments.

For all other following transactions, processes can get even faster, within 24 working hours. This can help businesses hold healthy cash flows and avoid delays in getting these international payments.

Karbon Forex provides a significant time advantage compared to traditional banks or payment gateways, which take 1-5 business days to process international transactions. Therefore, it becomes an ideal solution for businesses requiring quick access to funds for operations, payroll, or inventory management.

Does Karbon Forex Offer a Multi-Currency Account Besides USD?

Karbon plans to launch its multi-currency accounts everywhere; this will finally solidify its rank among the leaders that deal with cross-border payments for the businesses in India. Currently, Karbon Forex is only offering its account services in USD. We are working on expanding the offerings to include 12 more currencies so that businesses can easily accept payments from a larger client base around the world.

Our payment services are ideal for Indian business with clients operating in regions like Europe, Middle East, and Asia-Pacific, in which all major currencies all accepted, such as EUR, GBP, AED, and JPY. In addition, through multi-currency payment, Karbon Forex would avoid conversion procedures that may end up with expensive forex fees or longer processing periods.

For businesses primarily engaged in international trade, this increased currency support will make the process of conducting financial transactions easier and help in building relationships with clients who like to transact in their local currency.

Is providing an invoice compulsory while accepting international payments in India?

Yes, providing an invoice is mandatory to accept international payments in India. This requirement helps ensure that the transaction complies with regulatory guidelines and goes through smoothly.

The invoice is a formal record of the payment, including all the necessary information such as the business name, services or products provided, amount due, and payment terms. It helps establish the purpose of the international transaction, which is crucial for meeting Reserve Bank of India (RBI) compliance and avoiding any delays or rejections in processing the payment.

Clear and accurate invoices to the clients create trust, while providing a transparent paper trail for audit and financial reporting. Proper documentation is important to streamline transactions and ensure smooth cross-border payments.

Is the Karbon Forex Fee a One-Time or Recurring Charge?

The Karbon Forex fee is a one-time charge applied to each transaction. It is incurred when the client transfers funds to a virtual account through Karbon Forex and then withdraws the amount to their Indian bank account.

Unlike the subscription-based fees or monthly charges common with some payment gateways, Karbon Forex's one-time transaction fee ensures that businesses only pay for the services they use.

This pay-as-you-go model would greatly benefit the business with irregular international payment volumes because it completely removes unnecessary recurring costs while retaining transparency. What's more, Karbon Forex does not introduce hidden fees or other charges on top of what has been presented in the margin on forex plus any applicable tax like GST; thus, clarity about cost is well assured.

The fee structure is simple, and transaction-based, keeping it cost-efficient to manage cross-border payments. Its flexibility makes Karbon Forex the perfect solution for both startups and large enterprises, which need international payment processes to be optimized.

Which Bank Is Karbon Forex Tied Up With to Accept International Payments in India?

Karbon Forex has collaborated with JP Morgan, USA - one of the most recognized and respected banking institutions globally to offer international payments services to Indian corporates. Being the world's largest exchange bank, JP Morgan has successfully streamlined and secured cross-border transactions worldwide.

Once a remittance is initiated by Karbon Forex, the transaction goes first on JP Morgan's advanced banking network before reaching the recipient's account in an Indian bank. As such, these collaborations provide fast transactions, extra security, and reduced forex compared to other available banking routes. By utilizing the solid infrastructure of JP Morgan, Karbon Forex guarantees a hassle-free inward remittance experience and acts as a dependable platform for businesses that need to receive quick and affordable international payments.

What are the Currencies Karbon Can Process to Accept International Payments in India?

Karbon Forex supports inward remittances in 30+ currencies. This provides the business with numerous options to accept international payments, including all the major global currencies such as:

USD - United States Dollar

GBP - British Pound Sterling

EUR - Euro

AUD - Australian Dollar

CAD - Canadian Dollar

This wide currency support enables businesses to receive payments from clients from various continents without requiring multiple bank accounts or payment solutions. Be it clients on the North American, European, Asian, or Australian map, Karbon Forex simplifies the payment process by converging several currencies under one streamlined platform.

Who Issues FIRC?

An FIRC is an important document to receive international payments in India. It is considered a proof of receipt of foreign currency and, most of the time, the regulatory bodies ask for it, like RBI and Income Tax Department, for compliance and reporting purposes.

When any payment is received through Karbon Forex, then the inward remittance is facilitated by JP Morgan, USA. Although the transactions pass through the conduit of JP Morgan, the actual amount is remitted directly into the Indian recipient's bank account. The FIRC for the transactions is then issued by the Indian bank into which the money is finally deposited.

Karbon Forex ensures the process to be effortless, while getting the funds transferred internationally and transferring them to any Indian bank, ensuring no extra charges and completely stress-free. Businesses don't have to worry about any complicated procedures; Karbon Forex takes care of the whole backend, while completely being in line with Indian financial regulations.

Could Karbon Forex Help in the Onboarding of Proprietorship Sole Owners for Accepting International Payments in India?

Yes, Karbon Forex allows sole proprietors to receive international payments in India. Actually, Karbon Forex is tailored for a variety of business entities, including sole proprietors, small businesses, and large corporations. Whether you have an online store, consulting services, or any other business, Karbon Forex offers an efficient solution to manage cross-border payments.

For the sole proprietor, Karbon Forex doesn't present any extra unnecessary hurdles, but does necessitate some documentations. It is essential that the sole proprietors should produce GST certificates or shop establishment certificates, for verifying their business with all regulatory aspects, while carrying international payments through Indian mediums. This also will validate the genuineness of the firm and comply with Indian regulations under foreign exchange operations.

While many payment processors are targeting the bigger businesses, Karbon Forex identifies the growing number of sole proprietors who are reaching out to more people across the globe. In line with the growing demand for international transactions, Karbon Forex supports sole proprietors by making it easy to accept foreign remittances without the hassle of cumbersome paperwork or complex setups.

Onboarding for sole proprietors is streamlined, and the process is quick and hassle-free. Karbon Forex allows businesses to tap into the global economy by providing secure, low-cost transactions with major currencies such as USD, EUR, GBP, and others. Whether you are a freelancer, independent contractor, or small business owner, Karbon Forex is a great solution for enabling seamless international payments.

Is a GST Certificate Needed for Inward Remittance?

The GST certificate serves as proof that the business is registered with the GST Department and allows businesses to handle inward remittances from international clients in compliance with Indian tax regulations. Not even sole proprietors are an exception to this rule, and having a GST certificate allows them to legally receive payments from foreign clients without running into issues with tax authorities.

In cases where a sole proprietor does not have a GST certificate, Karbon Forex accepts a shop establishment certificate as an alternative. This certificate confirms that the business is properly registered and operates under applicable laws, allowing for smoother onboarding and transaction processing.

Karbon Forex ensures that this inward remittance process is transparent by mandating these documents. It means that the account will not come up with some roadblocks that may delay payments. Good standing is usually maintained by companies with Indian authorities without any problem regarding payments.

Which account will the money come into?

The money will come into your chosen Indian bank account. When businesses accept international payments using Karbon Forex, the steps involved in sending money from India is a multi-step process that must be followed so that the transactions are safe and efficient.

Firstly, when the client initiates a payment, the funds are transferred through Karbon Forex's trusted banking partner, JP Morgan, acting as an intermediary in the transaction. Being the largest exchange bank in the world, JP Morgan ensures the safe transfer of funds from the foreign bank to the recipient's Indian bank account.

Then the funds are transferred into a bank account of your choice in India. Karbon Forex allows you to link your preferred bank account within India, so your money is received in the account you use for business transactions. This adds convenience and flexibility because you can choose any bank in India to receive the payments. The transfer process is smooth, plus there is an added advantage of zero additional fees in transferring funds between banks, and Karbon Forex is efficient and cost-effective when it comes to managing international payments.

Multiple intermediary accounts need not be entertained in this system, and all international payments come directly to businesses without any kind of delay. With Karbon Forex, companies do not need to worry about the complexities that come with making cross-border payments. The money will come directly into the account that you choose, meaning you can quickly access your money.

Are there any charges for holding the funds in the virtual account for 60 days?

No, Karbon Forex does not charge any fees for holding funds in the virtual account for up to 60 days. This is a very convenient feature for businesses to have flexibility in managing international payments. Businesses can hold their funds for an extended period, which gives them more control over when and how they move their money into their Indian bank accounts. Whether the money needs to be consolidated or the timing of the transfer depends on cash flow or business strategy, Karbon Forex offers an efficient, no-cost solution.

This zero-cost holding option is great for businesses dealing with international payments because it does not involve additional fees, which are often charged on holding funds in a virtual account. Most other payment platforms and financial services charge a storage fee for holding funds over an extended period; however, Karbon Forex enables the business to maintain their funds secure in a virtual account without incurring extra costs.

Reach out to us today!