Every year, non-resident Indians from all corners of the world initiate inward remittance to India, for funding investments or supporting their families back home. The heart of this process lies in how money flows from overseas to India.

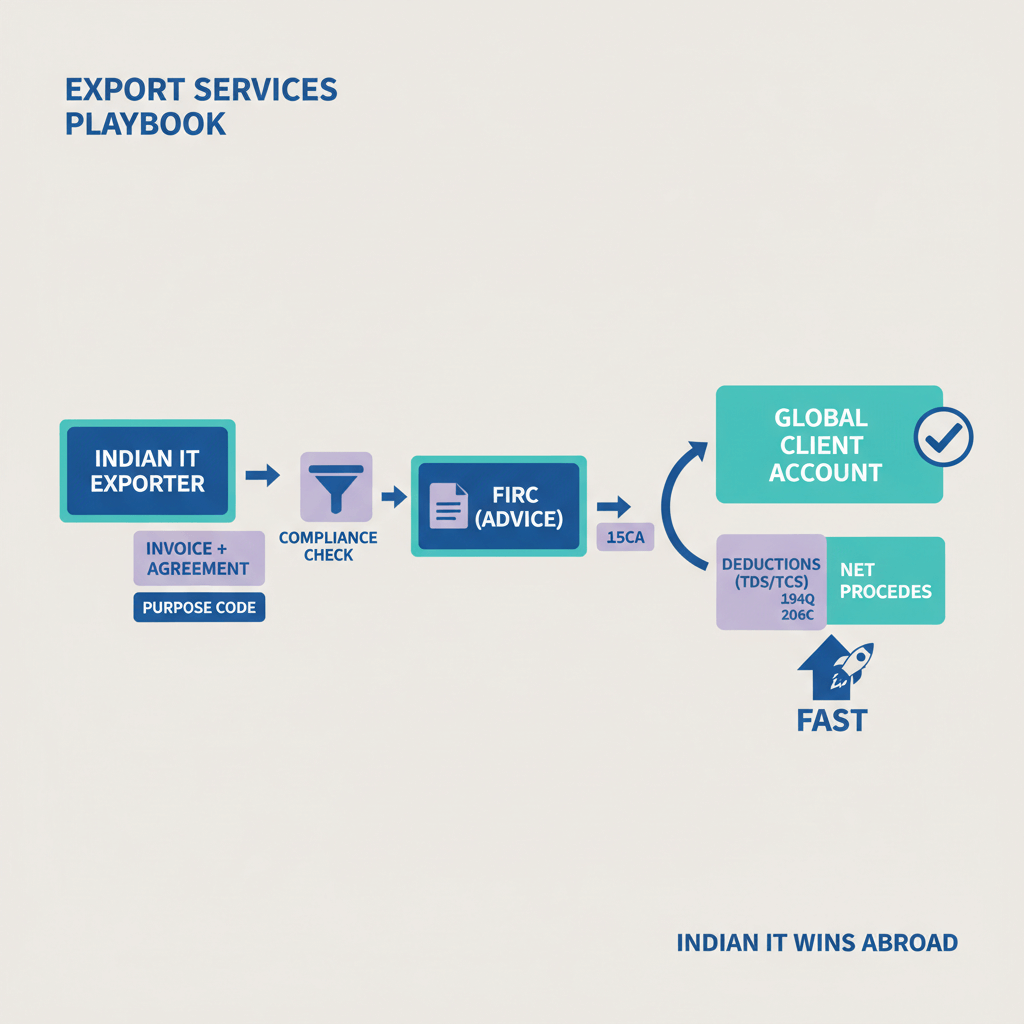

In the case of B2B cross-border payments for inward remittance to India, the process is slightly different, requiring a different set of documentation.

In this blog, we talk about the general procedure for inward remittance to India, the business inward remittance process, and things to avoid while initiating an inward remittance to India transaction.

What is an inward remittance?

Personal inward remittance to India

To better understand, let's consider an example. Alok, an engineer, is working abroad and sends a portion of his monthly salary to his elderly parents residing in India. Whenever Alok sends money to his parent's bank account, which is most likely a savings account, it is referred to as an outward remittance. However, for Alok's parents who are receiving the funds, it would be considered an inward remittance.

Business inward remittance to India

Consider a scenario where a multinational company, headquartered in the United States, operates a branch in India. The Indian branch needs additional capital to expand its operations and invest in new technology. Consequently, the U.S. head office decided to send a substantial amount of funds to the Indian branch to facilitate these developmental initiatives.

In this situation, the inward remittance functions as a strategic financial decision for the business, enabling the company to provide support to its Indian operations, promote growth, and enhance technological capabilities. The funds transferred from the U.S. would adhere to the regulations established by the Reserve Bank of India, ensuring that the transaction aligns with the purpose of inward remittances. The same holds in case an Indian vendor needs to be paid by an international entity, outside India.

RBI Guidelines: Inward remittance to India

The Reserve Bank of India (RBI) has set forth regulations to oversee inward remittances. According to these guidelines, an inward remittance is permitted for specific reasons, including education, medical treatment, travel expenses, investments, donations, living expenses, providing financial assistance, or as a gift.

Process of Inward Remittance to India

Getting money online through remittance is an uncomplicated process that involves first providing specific information to the sender.

If banks require additional details, it is better to find out what they need before initiating the transaction. This may include the no objection certificate, TRC, etc. After providing the necessary information, the remittance process is initiated from the bank account.

Following the initiation of the remittance, you will receive a notification either by email or SMS, notifying you when the funds have been credited to your account as an inward remittance.

Make Note: In the case of FinTech, the procedure for inward remittance to India involves real tracking on dashboards that are customized for the best customer experience. Banks may or may not provide this service. Make sure to find out, to experience a hassle-free international payment process.

Bank charges for Inward Remittance to India

In general, the following are the charges and time taken under the inward remittance to India process:-

- Forex Margin: 1.5% - 2.5% (plus additional charges)

- Transaction fees or SWIFT payment fees: $5 - $50

- Time Taken to Process the Transaction: Banks take 4 - 5 days

- FIRA documentation: Provided by banks at an extra cost.

- Invoice Tracking: Not provided by banks. You may consider neobanks that provide a customized user dashboard for real-time tracking of inward remittance payments.

What are the rules for inward remittance to India?

In the process of inward remittance, there are several parties and factors involved. Here is a detailed analysis of these factors:

The Sender

The sender or remitter is the person who initiates the transfer of international money by visiting their bank and providing the required details for payment to the recipient's bank account.

- Nationality of bank

- The remitter's name and address

- Bank branch details

- Bank account number

- Bank swift code

After the transaction is completed, the sender's bank updates them on the transfer, and the remitter may send remittance advice (FIRA) to the recipient to notify them.

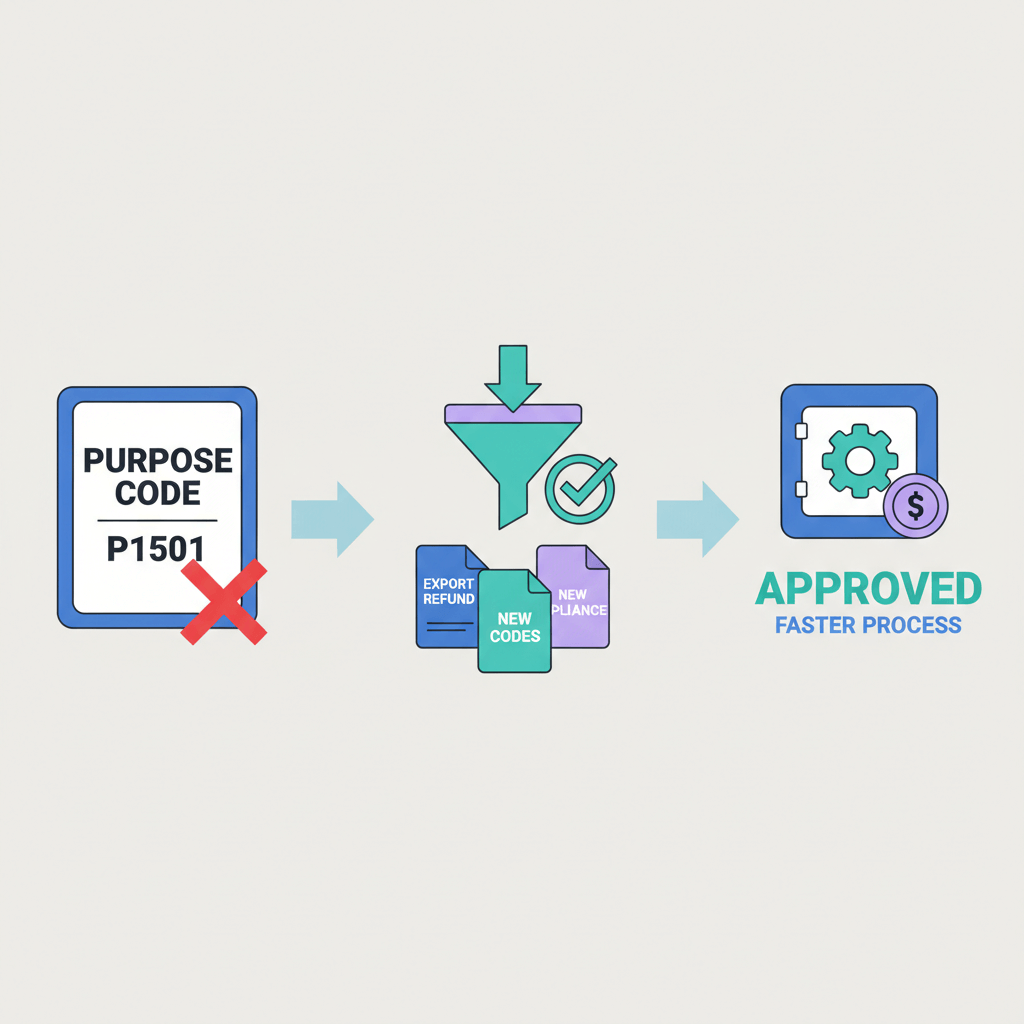

The Recipient

The beneficiary, who receives the inward remittance, needs to provide their bank with documents, including a copy of the contract or agreement with the sender, remittance details, payment invoice or receipt, and a purpose code for the transaction. Keeping proper records is crucial, and obtaining the Foreign Inward Remittance Certificate (FIRC) from their bank is also important for the beneficiary.

What Are the Different Kinds of Foreign Inward Remittance Certificates?

The Foreign Inward Remittance Certificate (FIRC) comes in two forms: physical and electronic. A physical FIRC is a hard copy of the certificate, while an e-FIRC is a digital version.

To obtain an e-FIRC, the bank initiates an Inward Remittance Message (IRM) on the official government money remittance portal. After fulfilling all the requirements, the IRM number is converted to the e-FIRC number. It is crucial to maintain accurate documentation and record-keeping of both types of FIRCs for future reference.

How Do You Request an FIRC for Inward Remittance to India?

To acquire a FIRC, you need to provide your bank with specific information, such as:

• Account number

• Transfer date

• Amount of transfer

• Purpose of the transfer

• Beneficiary details

• Unique Transaction Reference (UTR) number

Inward remittance

When funds are received in an Indian bank account from relatives residing outside the country, it falls under the category of inward remittance, subject to the regulations outlined in the Foreign Exchange Management Act (FEMA).

The funds are not subject to taxation only if they are utilized for specific purposes such as covering living expenses, medical treatment, education, charitable donations, travel expenses, and gifts. However, if the recipients invest the money, any income generated from such investments is subject to taxation.

According to the Reserve Bank of India (RBI) and FEMA guidelines, the following individuals can receive tax-free money through inward remittance:

What Information Does the FIRC contain for inward remittance to India?

The FIRC includes the recipient's name and the mode of payment, which may be through direct cash payment or credit to the recipient's account. Furthermore, the FIRC specifies the name and address of the authorized bank remitting the funds and the remitter's address.

After filling out all the details, an authorized signatory from the approved designated bank signs the FIRC, and it gets issued to the account holder's address. This process generally takes place within 15 days from the date of remittance of funds. It is essential to keep the FIRC safe since obtaining a duplicate can be a complex and time-consuming process.

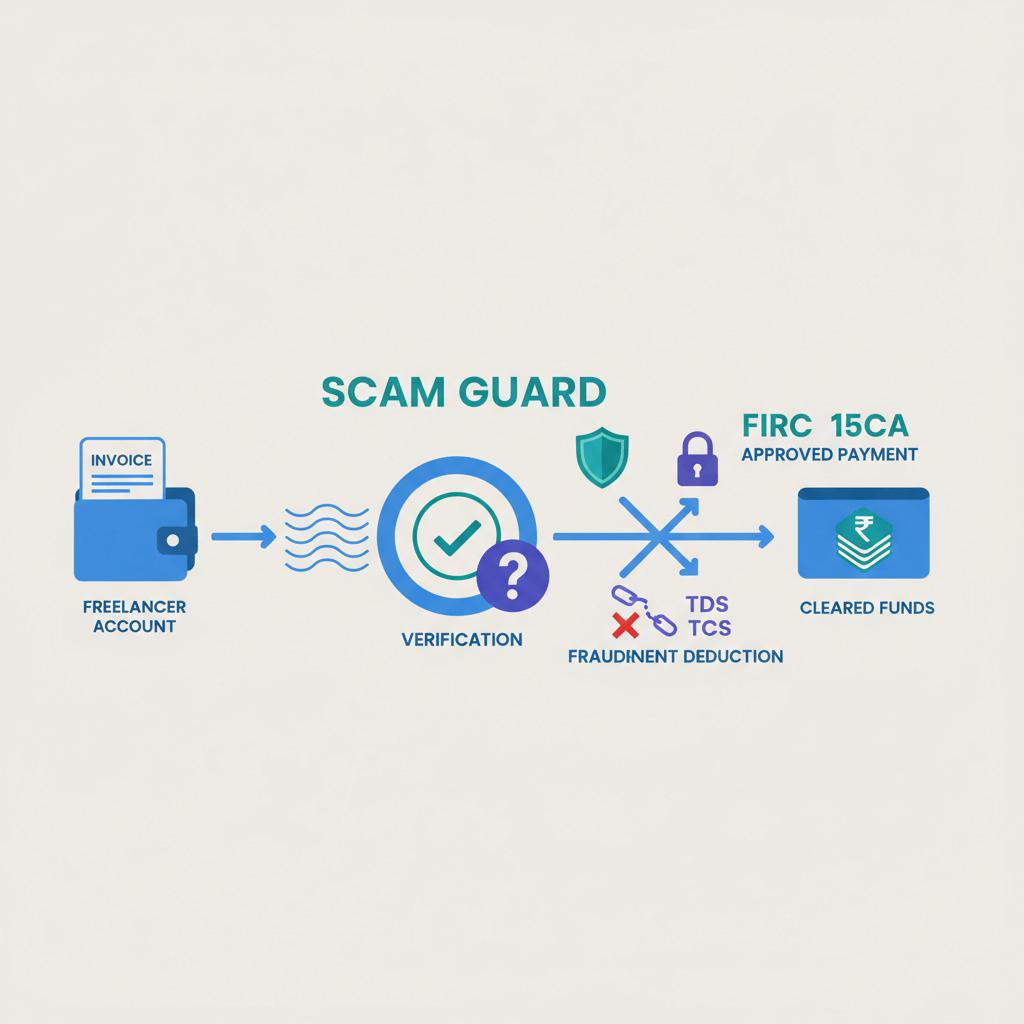

Things to Avoid While Conducting an Inward Remittance to India

- Select the right fintech

Initially, acknowledge that the responsibility of sending your money should be approached with caution. Select a bank with a global presence, as this can simplify the process and enhance security.

- Process just as important as institution of choice

Receiving money in India does not have restrictions. RBI and the GOI are particularly specific about the kind of money that leaves the country and hence they are very strict with rules and regulations.

FAQ

How Can You Remit Money in inward remittance ?

The commonly used method is international wire transfer, where the money is sent from one bank to another. Mobile money is another option where you transfer funds to an e-wallet.

Cash pickup is also gaining popularity, where you send money to a service provider and the recipient can pick up the cash by showing their ID and confirmation number.

Finally, there is home delivery, where the cash is delivered to a specified address, and the recipient shows their ID before receiving the cash. This option is particularly useful in remote areas or crowded towns where traveling can be time-consuming. For businesses, fintech options like Karbon Forex work out in the cheapest way possible with 0 FIRA and SWIFT fees.

How Do You Obtain Inward Remittance?

If you receive your salary or compensation in foreign currency, whether you're a salaried worker or freelancer, you can receive inward remittance. This also applies to those who run e-commerce shops and receive payments in foreign currency.

How long does it take for foreign remittance to India to be processed?

In general, it takes authorized banks one to two business days to process an inward remittance transaction. However, if you are receiving foreign inward remittance for the first time, it may take longer, typically around three to four working days.

What is the time limit for foreign inward remittance to India?

If you have received, earned, or have a foreign exchange that you have yet to use, it needs to be sent back to an authorized entity within 180 days from when you received it or returned to India.

Is It Safe to Remit Money? What is the Inward remittance to India limit?

Yes. Generally, fintechs and banks both provide a safe path for inward remittance to India.

While there is no restriction on the total remittance amount to India, it's worth noting that in the OPGSP model for inward remittances, the inward remittance to India limit is up to USD 10,000. It's possible to conduct multiple transactions, but they will be considered under a single invoice.

Is Remitting Money Expensive?

Yes, the cost to process inward remittance to India can be expensive, but varies based on the financial institution you opt for. Different banks or neobanks impose varying forex rates along with additional expenses on top of the base currency conversion charges.