Enjoy faster onboarding, the best forex rates, and dedicated compliance support built for Indian businesses and freelancers.

Your banks are taking too much time to process payments. You are searching for a payoneer alternative now that you want to give up on banks and private fintechs.

You have submitted an endless number of documents and still nothing seems to move forward.

Your payments are stuck and your international vendor has trust issues with you.

Your business is likely to face the brunt of this bank hassle.

Sounds all too familiar?

If you're ready to escape the high fees and unnecessary delays, it's time to explore better solutions.

In this article, we'll introduce you to the best Payoneer alternatives.

Read on to find out which one fits your business needs best!

What is Payoneer and how does it work?

Payoneer is a cross-border payment service for businesses and individuals. Founded in 2005, the company provides its users with virtual accounts in various major currencies like USD, EUR, or GBP. It is widely used among freelancers, e-commerce sellers, and small businesses for international payments and receiving payments from marketplaces like Amazon, Fiverr, Upwork, etc.

Once the person signs up and gets verified, it is quite simple to receive a payment via direct transfers from clients or by payouts of global platforms. The same can be done by sending payments to another Payoneer account or directly to a recipient's bank account. Funds in the account can easily be withdrawn into local accounts anywhere in the desired currency or through the Prepaid Mastercard issued for Payoneer. Thus, with very competitive currency conversion rates and fees, Payoneer is the preferred choice for freelancers and MSMEs.

However, various modern alternatives exist to Payoneer that provide better services and rates in certain use cases.

Why Look for Alternatives to Payoneer?

Payoneer is one of the biggest service providers for international transactions. However, it is not the best choice. Many users, including Indian businesses, are forced to seek alternatives due to the following reasons:

1. High Fees

It has a percentage charge on every transaction and therefore can be pretty expensive to companies processing high-value payments. Secondly, most of its currency conversion rates have hidden markups in the fine print, therefore making it more expensive than other platforms.

2. Lack of Flexibility

Payoneer mainly operates with pre-approved sites and partners, such as marketplaces or freelance sites. This limits your choices if you will need a much more flexible solution for direct B2B transactions or payments outside its system.

3. Issues with Customer Service

Being an online-only platform with very few physical offices, it can be hard to get hold of the right support executive. Most of the users complain that it does not solve the problem within the stipulated time. Indian companies are restricted to their regions and have slower times to solve queries too.

4. More Features Elsewhere

With the rise of new fintech platforms, many businesses are finding alternatives that are more suited to their specific needs. Features like multi-currency accounts, faster processing times, and lower fees are increasingly available on other platforms, making them more appealing to modern businesses.

If these limitations resonate with your experience, exploring Payoneer alternatives could provide you with a better solution for your international payment needs.

Top 10 Alternatives to Payoneer

Karbon Forex

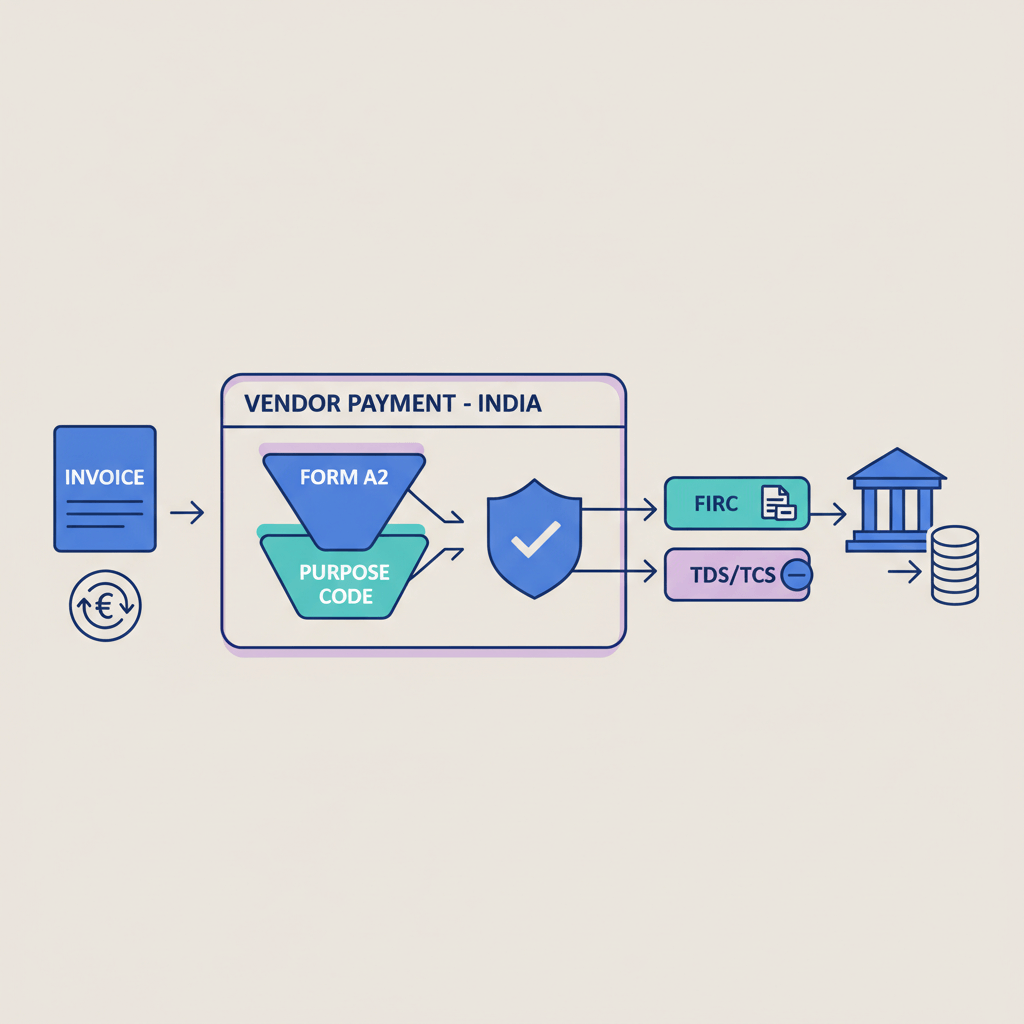

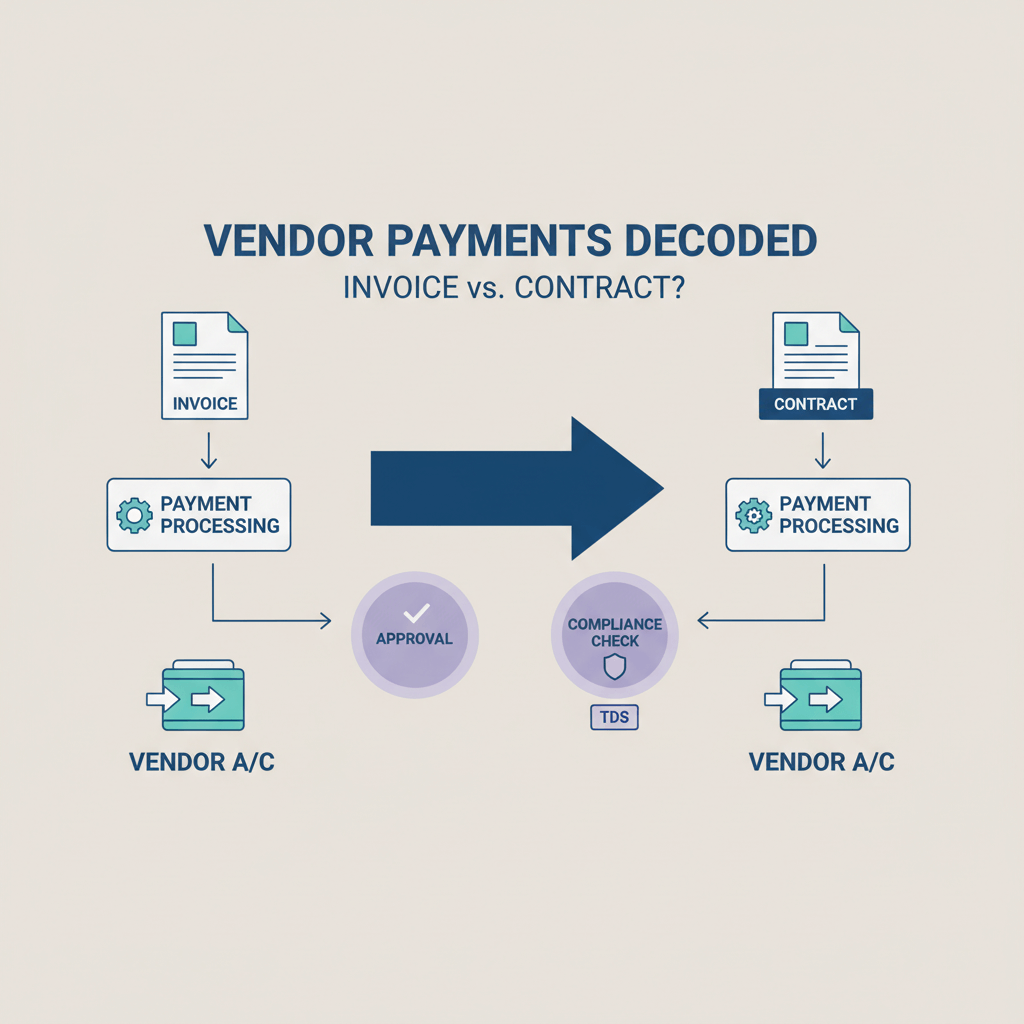

Karbon is the best alternative to Payoneer for Indian companies that do cross-border transactions. It specializes in international transactions for Indian businesses and freelancers. All the related forms and filings like 15CA, 15CB, and A2 are provided and payments are quickly processed within 48 hours

Best For: Indian businesses and freelancers.

Fees and Charges: Live forex rates; 0% mark-up. Upto 1% fees.

Wise

Wise is one of the better-known alternatives to Payoneer. It has clear and transparent fees and mid-market exchange rates. It's ideal for small businesses or freelancers that need to stay away from hidden markups. The platform also offers a multi-currency account to make the process of sending and receiving payments easier.

Best For: Small businesses and freelancers who need transparent fees and mid-market exchange rates.

Fees and Charges: Flat fee plus a percentage of the transfer amount ( between 0.4% and 1%). Currency conversion uses real mid-market rates.

Revolut Business

Revolut is an excellent choice for businesses, offering a suite of financial tools, including multi-currency accounts and instant currency exchange at interbank rates. This is the ideal choice for startups or e-commerce businesses that need to have flexibility and quick access to funds.

Best For: Startups and e-commerce businesses requiring quick currency exchanges and expense management tools.

Fees and Charges: Free account options with limited features; paid plans start at ₹250/month. Currency exchanges are free up to a limit, then charged at 0.4%.

PayPal

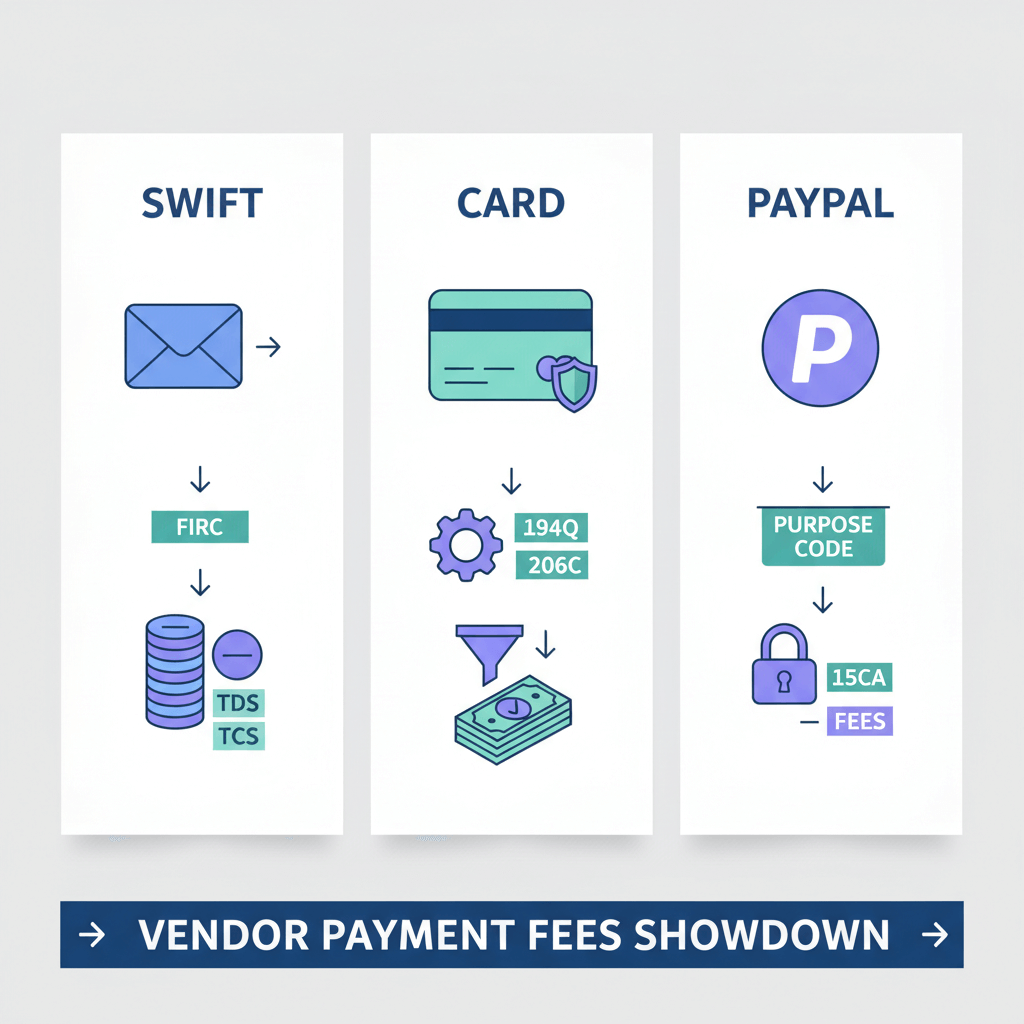

PayPal is also a popular platform that can be a good alternative to Payoneer. It supports most currencies and makes it easy to transfer funds overseas. However, with higher transactional charges and currency conversion rates, it might not go down well with cost-sensitive businesses.

Best For: Businesses working with international clients or marketplaces like eBay or Etsy.

Fees and Charges: 2.9% fee per transaction. The currency conversion fee is around 3-4%.

Stripe

Stripe is a very strong platform for companies working on an e-commerce or subscription-based model. International payments are supported and they have tools to manage recurring payments, which would make it viable for companies that have large volumes of transactions.

Best For: Subscription-based businesses and e-commerce platforms with high transaction volumes.

Fees and Charges: 2.9% per transaction for international cards. Currency conversion rates apply with an additional 2% fee.

Skrill

Skrill is a simple cost-effective international payment platform. This means that it is a viable alternative for businesses, particularly in terms of lower fees and faster processing than Payoneer. However, it does not offer the same level of ecosystem integrations as Payoneer.

Best For: Small businesses looking for a cost-effective and easy-to-use alternative to Payoneer.

Fees and Charges: 1.45% per transaction for sending money; currency conversion fees start at 3.99%.

WorldFirst

WorldFirst services companies that require international transfers with competitive exchange rates. It is a strong alternative for e-commerce sellers and B2B transactions, offering services customized for global trade.

Best For: E-commerce sellers and businesses managing international trade and large transactions.

Fees and Charges: Free account; low margins on exchange rates (typically 0.5%-1%). No fixed transaction fees.

OFX

OFX specializes in large international transfers at competitive rates. It has no maximum transfer limit and personalized customer support, making it a great alternative for businesses dealing with high-value transactions.

Best For: Businesses dealing with large international payments that prioritize low fees and strong customer support.

Fees and Charges: No fixed fees for large transfers; competitive exchange rates with a small markup (typically 0.4%-1%).

Pioneer Direct

It's a relatively new international payment gateway, allowing international direct transfers at relatively low fees. It specializes in simplicity and speed of execution, and it makes a good payment process for companies looking for streamlining.

Best For: Businesses looking for straightforward, fast, and low-cost international transfers.

Fees and Charges: Low transaction fees starting at 1%. Currency conversion fees depend on market rates.

Remitly for Business

Remitly offers fast, secure cross-border transfers for small businesses. Originally designed for remittances, business services by the company have grown to serve as an inexpensive way that companies can send payments abroad.

Best For: Small businesses sending payments abroad with a focus on affordability and reliability.

Fees and Charges: Fees vary by destination and transfer speed; typically between 1.5% and 3%.

Comparison of the Top Payoneer Alternatives for Indian Businesses

Disclaimer: Details in this table are subject to change. Verify features, fees, and terms with the service provider before making decisions.

How to Choose the Best Payoneer Alternative

The best Payoneer alternative depends on your business needs. Wise and Karbon Forex are good options if speed is an important requirement. Those in need of a wide number of currencies and robust integration might prefer Stripe or Revolut. Those who need user-friendly interfaces, with favorable fees, find PayPal or Skrill good candidates.

Karbon Forex is a great solution for Indian businesses in their international payments. Competitive rates, smooth handling of compliance, and efficient support make Karbon the transaction solution that can be delivered cost-effectively and hassle-free.

Evaluate your priorities and test each of the platforms so as to find one that accurately aligns with your specific business goals.

FAQ

1. How do these platforms ensure compliance with international regulations?

Platforms like Karbon Forex and OFX are very compliance-friendly platforms. They help in managing regulatory requirements such as documentation, tax filings, and adherence to local laws (e.g., 15CA/15CB filings in India).

2. What is the best Payoneer alternative for Amazon Business, KDP, or Affiliate payments?

For Amazon Business and KDP payouts, Wise and Karbon stand out for their competitive exchange rates and ease of receiving international payments. PayPal is another popular option for affiliates due to its widespread use and seamless integration with affiliate networks.

3. What is the best Payoneer alternative for freelancers having multiple international clients?

Both Wise and Skrill are good options for freelancers because both offer multi-currency accounts. In this way, it is easy to receive payments from clients around the world without having to open several bank accounts. Wise offers a clear exchange rate and fees, and Skrill is helpful in terms of rapid transfer and invoicing tools for smaller business needs.

4. How do payout methods differ across Payoneer alternatives?

Payout methods vary greatly:

Karbon Forex: Direct bank transfers with the fastest TAT.

Stripe: Payouts go directly to bank accounts; supports custom integrations.

Revolut: Offers bank transfers and in-app transfers between Revolut accounts.

PayPal, Skrill, Wise: E-wallet Payouts, to transfer the amount to their banking account or spend them as needed.

Your selection depends on your recipients' preference, and how fast and affordable it will be to the transfer.