When something involves money and business there is no such thing as limitless access. The limit of business outward remittance from India has been a complex, if not confusing state of affairs in India.

The start of the year is filled with talks on budget and economic surveys.

Economic Times and every fintech app you know are filled with tons of information for businesses, confusing you with the tax on business remittances applicable and the limit on outward remittance from India.

More often than not, firms reach a saturation point where they aren't aware or care about the exorbitant amount of fees that are applicable on business outward remittances.

Hence, in this blog post, we break down the nuances of business outward remittance, the limit of business outward remittance, and what you shouldn’t do to invite extra taxes on those international business payments.

Read On…

What is a Remittance?

Remittances involve the transfer of funds between parties, whether it be for bills, invoices, or even as a heartfelt gift. However, the term "remittance" specifically refers to the funds that migrants send back to their families in their home country while residing and working abroad. These transfers are commonly known as worker or migrant transfers.

When it comes to foreign remittances, there are various options available in India. You can opt for bank transfers,, or even mobile wallets. Inward remittances involve receiving money in India, whereas outward remittances from India entail sending money out of India.

The Foreign Inward Remittance Limit (FIRL) and Foreign Outward Remittance Limit (FORL) are monetary boundaries set by the Reserve Bank of India (RBI) to regulate the inflow and outflow of funds into and out of the country during a fiscal year.

Business Inward Remittance

Personal inward remittances involve the transfer of money by an individual for their personal use. This can include expenses related to medical treatments, education fees, or supporting family members.

Non-personal inward remittances include business inward remittance that involves the transfer of money by foreign companies or organizations into India. These remittances can be for purposes such as business investments.

Business Outward Remittance

Personal outward remittances involve the transfer of money by an individual for personal expenses. This can include payments for medical treatments, education fees, or supporting family members residing in a foreign country.

Non-personal outward remittances that include business outward remittance, on the other hand, involve the transfer of money by an Indian company or organization to a foreign country.

What is RBI’s Liberalised Remittance Scheme (LRS)

In 2004, the Reserve Bank of India (RBI) implemented the Liberalised Remittance Scheme (LRS), which enables residents of India to transfer up to US$250,000 (INR 2,04,50,250) per financial year for approved current or capital account transactions.

This scheme enables individuals to engage in various activities, including trade payments, investments in permitted capital instruments, sending money abroad up to the specified limit, private visits and holidays, and medical treatment expenses abroad within the aggregate limit.

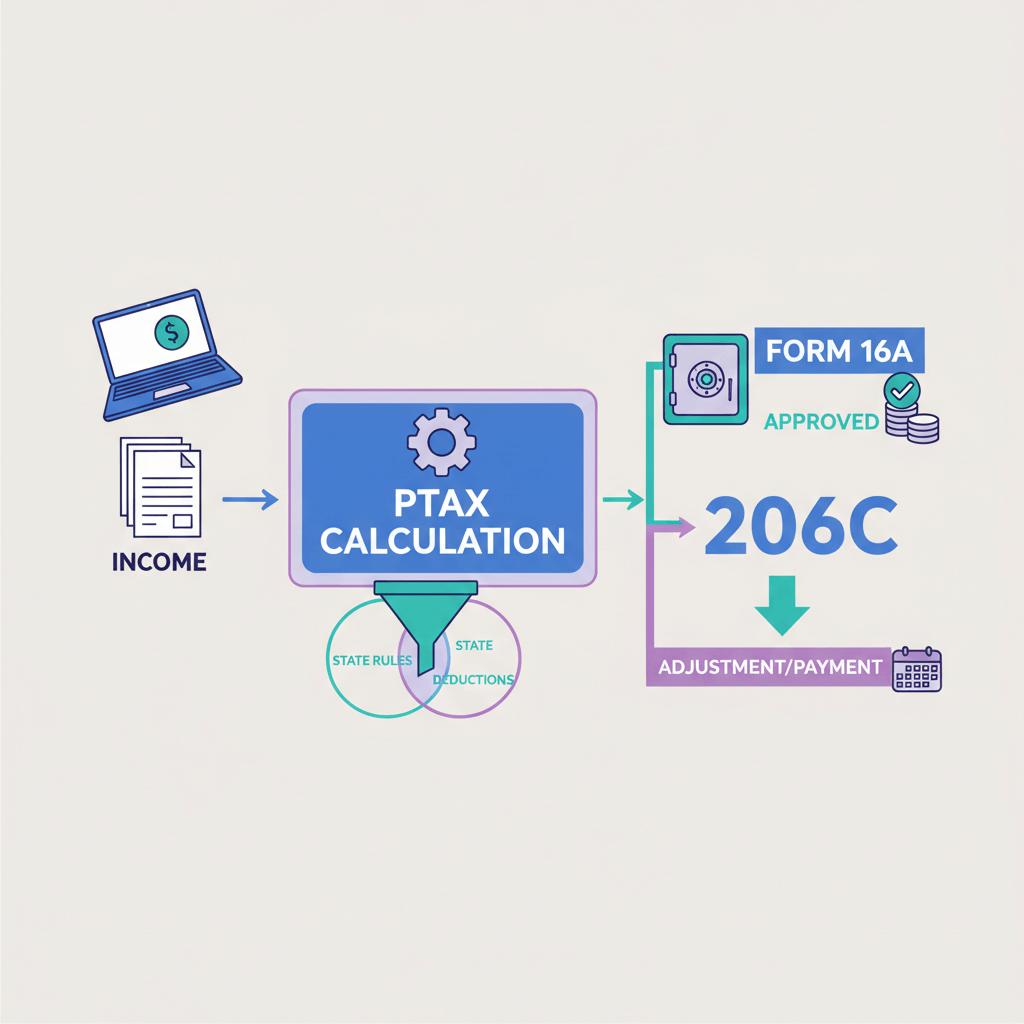

Additionally, transactions exceeding Rs. 7 lakhs are subject to a tax collected at the source (TCS) of 5%. However, in the 2023-24 Budget announcement, the TCS rate for foreign remittances was raised from 5% to 20% of the transaction amount . The objective behind this increase is to target affluent individuals who may attempt to evade taxes.

But there is no limit for business outward remittances from India The Reserve Bank of India (RBI) has set a cap at US$250,000 (approximately INR 2,04,50,250) only for individuals and NOT for businesses.

What are the taxes applicable for business outward remittance from India?

- Goods and Services Tax (GST): GST on outward remittance may be levied on exports but can be claimed as a refund or subject to export-related exemptions or concessions.

- Withholding Taxes: The government may impose withholding taxes on specific types of international business payments. The rates and applicability of withholding taxes vary based on the nature of the payment and the tax treaties, if any, between India and the country you are sending the money.

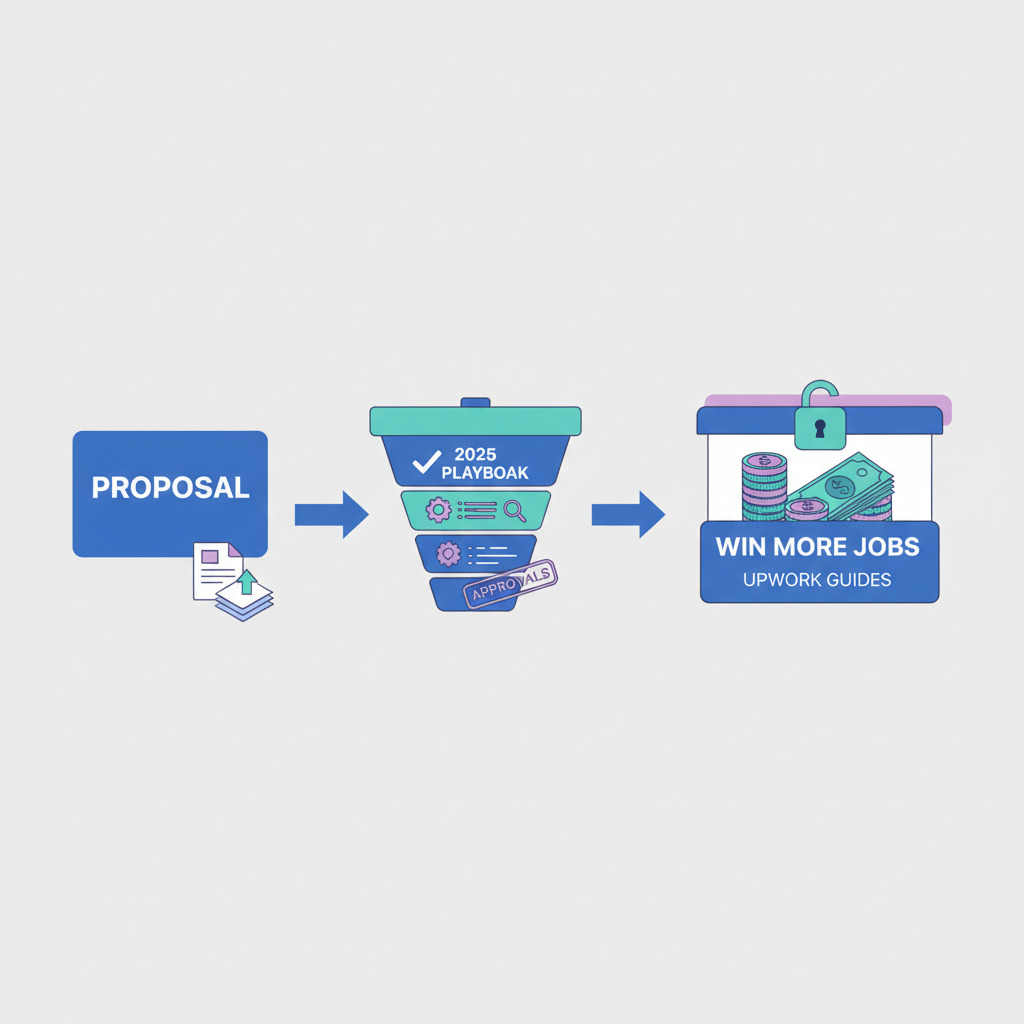

What should you do to save taxes applicable on business foreign remittance?

- Deductible Expenses: Identify and claim all eligible business expenses related to the outward remittance. This includes costs such as transportation, packaging, insurance, or any other relevant expenses incurred in connection with the purchase of raw materials. By deducting these expenses from your taxable income, you can reduce your overall tax liability.

- Transfer Pricing: Ensure that the pricing of the transaction with the foreign supplier is conducted at arm's length, by transfer pricing regulations. This helps to demonstrate that the amount paid for the raw materials is reasonable and aligns with market rates, reducing the chances of any potential tax disputes or adjustments.

- Tax Treaties: Check if there is a tax treaty in place between India and the country where the foreign supplier is located. Tax treaties for business outward remittance often provide provisions to avoid or minimize double taxation and provide potential tax benefits. Analyze the treaty provisions to determine if any exemptions or reduced tax rates apply to your business transaction.

- Tax Planning and Structuring: Seek professional advice from a tax expert or consultant who can guide you on effective tax planning and structuring strategies.

- Consultation with Tax Authorities: You can consult tax authorities or seek clarification on any specific provisions, regulations, or procedures related to TCS and business outward remittances.

Final Word

Having a clear understanding of the limit of business outward remittance is crucial for businesses operating in India. The Indian government is very tight about money moving out of the country. Hence breaking even one tax law or foreign money transfer rule can ruin your transaction process.

We hope that this blog post has served as a helpful guide for navigating the aspects involved in business outward remittance from India.

FAQs

1. How much money can be transferred abroad annually?

The Reserve Bank of India (RBI) has established a maximum threshold of $250,000 (equivalent to approximately INR 2.04 Lakhs) per fiscal year for foreign remittances. It is important to note that this limit encompasses both individual and business-related transactions, ensuring compliance with RBI regulations.

Any remittance amount that crosses this limit requires you to take prior permission from the RBI itself. So if your requirement has a higher limit of business outward remittance from India, make sure to get permission.

2. What are the documents required for businesses to send money abroad?

If you're looking to send money abroad from India, you'll need to have the following documents:

- A PAN card

- Form A2

- 15 CA 15 CB forms as provided by a chartered accountant

- Documents supporting the purpose of the transaction (e.g. invoices among others)

3. What are the RBI exemptions for business outward remittance for from India?

- Trade Credit: RBI allows businesses to avail trade credit from foreign entities for importing goods and services without seeking prior approval in some cases.

- Export Proceeds: There are exemptions for the remittance of export proceeds, where businesses can repatriate the proceeds from the export of goods and services without any specific approval, subject to fulfillment of prescribed conditions.

- Royalties and Technical Fees: Under certain conditions, businesses may be eligible for exemptions on remittances related to royalties, technical fees, and payments for the use of intellectual property rights.

- Branch Office Expenses: Expenses related to branch offices, representative offices, or liaison offices outside India may be exempted from certain restrictions on outward remittance, subject to compliance with specific conditions.

- Specific Sectors: Depending on the industry or sector, there may be specific exemptions or relaxations provided by the RBI for outward remittances, such as in the case of startups, research, development, etc.

4. What is the threshold limit for business foreign remittances?

According to the Reserve Bank of India's (RBI) Liberalized Remittance Scheme (LRS), an individual has the authority to send up to $250,000 annually overseas without seeking approval from the RBI. However, any remittances surpassing the $250,000 threshold or its equivalent in foreign currency must be approved by the RBI.

5. Are there any limitations of the liberalized remittance scheme?

While the liberalized remittance scheme (LRS) offers numerous benefits, it is important to be aware of the restrictions and limitations associated with it.

The LRS does not permit remittances for certain activities such as real estate transactions, purchasing lottery tickets, engaging in margin trading, and speculating in foreign exchange markets.