As the Indian economy expands, Indian businesses are expanding globally. This makes international money transfer from India crucial in managing suppliers, employees, and other payments. Selecting the right way to send money internationally is crucial for businesses. The wrong choice can lead to high fees, poor exchange rates, and delays, which can hurt a company’s finances and operations.

In this blog post, we shall discuss the different factors involved in international money transfers from India and specific corporate international money transfers from India.

Let’s deep dive!

International Money Transfer From India

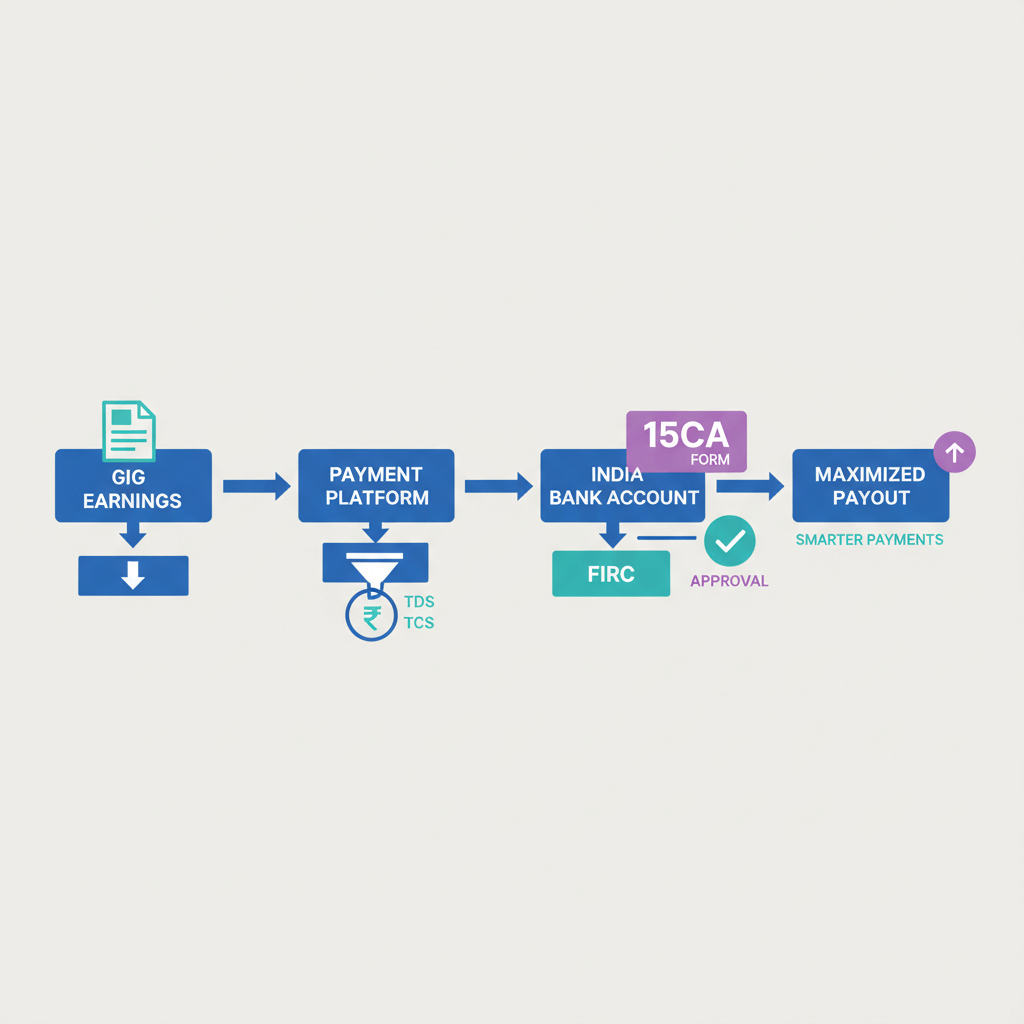

Indian citizens can transfer money from India to other countries by following a process known as outward remittance. This process is regulated by various foreign regulations, as per the guidelines set by the Reserve Bank of India (RBI).

- Outward remittance from India can be processed through channels like banks, POs, and digital payment platforms.

- According to RBI, individuals or firms are allowed to transfer up to $250,000 per fiscal year for business visits, gifts, overseas education, leisure visits, etc.

- The necessary documents required for making an outward remittance vary depending on the chosen bank and platform, but usually include a copy of the Permanent Account Number (PAN) card, proof of adequate funds, original fee slip/receipt/bill (if applicable), Form A2, and other relevant documents.

- To process international money transfers from India, the RBI has established a process called outward remittance. This allows for money transfers to take place through banks, or post offices.

- As per the RBI guidelines, an individual or entity can transfer up to $250,000 from India to foreign shores per financial year for purposes such as medical reasons, business visits, education, leisure, donations or gifts, and other necessary expenses of relatives abroad.

- The necessary documents required for making an international money transfer from India may vary based on the chosen mode of transfer but generally include relevant personal identification documents, proof of adequate funds, and other relevant forms and receipts.

Documents for International Money Transfer From India

To conduct international money transfer from India or make an outward remittance, you typically need to provide several key documents, including

- A Permanent Account Number (PAN) card,

- an original receipt/bill/fee slip,

- proof of adequate funds, and

- Form A2.

Overseas Money Transfer from India - Factors to Consider

When making an international money transfer from India, there are several key factors to consider:-

- Exchange rates: You'll need to consider the exchange rate for converting one currency to another, which can impact the amount of money the recipient receives.

- Transfer speed: Depending on the international business payment method, the ideal time required for transfers can range from 48 to 72 hours, while demand drafts and cheques may take longer to process.

- Overhead charges: It's common to incur foreign conversion tax, transfer fees, and sometimes remittance service tax when sending money abroad.

Which method is best for international money transfer?

As digital payment portals continue to gain popularity, there are now numerous methods for international money transfer.

The specific method you choose will depend on various factors such as the purpose of the transfer, the time available, and the currency of the receiving country.

Here's a quick overview (with pros & cons) of all the ways to send money internationally from India:

Method 1: Bank Wire Transfer

Direct bank transfers are the go-to method for international money transfers for many businesses. Banks offer specialized accounts that are designed with Forex in mind, which massively cut down on costs and also provide various other benefits. But the bank charges can be obtuse or hard to figure out and some may also require heavy documentation for international transfers.

Pros:

- Security

- Suitability for Large Transactions

- Direct Transfer to Corporate Accounts

Cons:

- Higher Transaction Fees

- Slower Processing Times

Method 2: Online Money Transfer Services

Platforms like Wise, PayPal, Karbon, etc. offer fast, convenient, and cost-effective ways to transfer funds across borders. With easy-to-use interfaces and the ability to send money in multiple currencies, online transfer services are particularly beneficial for businesses with frequent transactions.

Pros:

- Lower Fees

- Faster Transactions

- Scalability for Businesses of All Sizes

Cons:

- Potential Limitations on Transaction Amounts

Method 3: Foreign Exchange (Forex) Dealers

Unlike traditional banks or online platforms, Forex dealers focus specifically on currency exchange and can provide competitive exchange rates. They are particularly useful for companies involved in large or recurring international transactions, as they can offer personalized solutions, including hedging strategies to protect against currency fluctuations.

Pros:

- Best for Large, Recurring Transaction

- Personalized Service

- Hedging Opportunities

Cons:

- Requires More Hands-On Management

Method 4: Business-Specific Remittance Solutions

Business-specific remittance solutions are specialized tools designed to meet the needs of companies involved in international transactions. These solutions include options like corporate remittance cards and dedicated remittance platforms, which allow businesses to send and receive funds across borders efficiently.

Pros:

- Pre-loaded with Foreign Currency

- Integration with Corporate Expense Management Systems

Cons:

- Limited Availability & Select Clientele

- Associated Costs for Maintenance and Transactions

Last Word

Besides the methods discussed earlier, there are numerous options available for transferring money abroad. It is crucial to exercise caution and ensure the reliability of the service provider.

While making a transfer, it is imperative to note the exchange rates and overhead charges involved.

Keeping a record of all transfer transactions is advisable for future reference. One must also be vigilant of scams and fraudulent activities.

FAQs

1. What is the cheapest way to transfer money internationally from India?

Typically, bank transfers are the most cost-effective way to fund your international money transfer through Wise. Although bank transfers may take longer than debit or credit card transfers, they often offer the most favorable exchange rates and fees

2. Can I transfer money from an Indian bank account to an international bank account?

Sending money abroad through online money transfer is a popular and easy method among Indians. To make a transfer, you only require the recipient's account details, along with the IBAN or SWIFT money transfer code of the recipient bank, and the account holder's information.

3. What is the cheapest way to send money internationally for businesses?

In the case of corporate Forex transactions direct bank transfers are not possible. Hence fintech services offer an easy way out for B2B forex transactions.

What is the limit of international bank transfers from India?

The Reserve Bank of India (RBI) established the outward remittance limit for international money transfers to a foreign bank account at USD 200,000 per year. Later, in 2013, with the depreciation of the rupee, the RBI decreased this limit to USD 75,000 per year. Presently, due to the appreciation of the rupee, the RBI has raised the maximum limit to USD 250,000.