We all know that international incoming wire fees to accept international payments in India can be costly.

The sole distinction between fintech solutions and bank rates lies in the flat fee applied to each incoming remittance.

So what are international incoming wire fees for inward remittance in India?

Read on to find out more…

#1 Do I get charged for an international incoming wire transfer?

Most banks in India do not charge any incoming wire fee from the receiver (at least on paper), However, accepting international payments in India can be costly due to several hidden charges that banks charge.

#2 How much does Swift charge per transaction under international incoming wire fees?

A SWIFT transfer incurs various currency conversion charges, including transfer fees, exchange rates, and hidden fees, with banks typically imposing a 3-5% charge with added GST taxes on the exchange rate for each transaction.

International incoming wire transfers, while a quick method, can be costly. However, incoming wire transfers might incur extra charges.

Pro Tip: Initiating an inward remittance transfer independently with the help of services like Karbon to accept international payments in India , can be more cost-effective than using bank customer service representatives.

An incoming international wire transfer is an electronic means of transferring money between bank accounts, available for international transactions.

#3 What is the EEFC international incoming wire fee?

Transfer into an EEFC account is free by most banks because there is no currency conversion required.

#4 What is the international incoming wire fee for a transfer from the USA to India?

For businesses, there's an option called Exchange Earners Foreign Currency (EEFC) to conduct inward remittance that retains the remittance amount received in USD itself. In India, you can open an EEFC Account to hold foreign currency without earning interest. It's like a current account for foreign currencies. This is useful if you receive money in USD and want to keep it in USD.

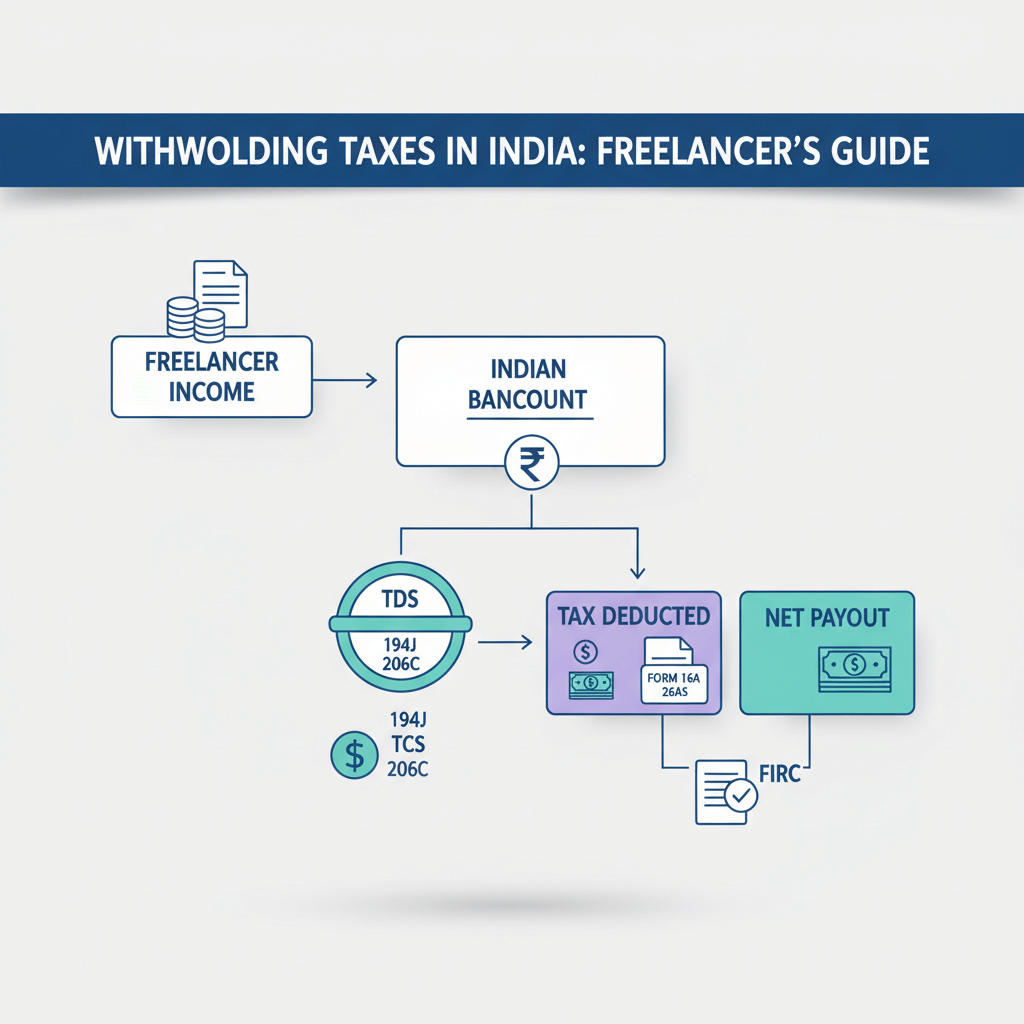

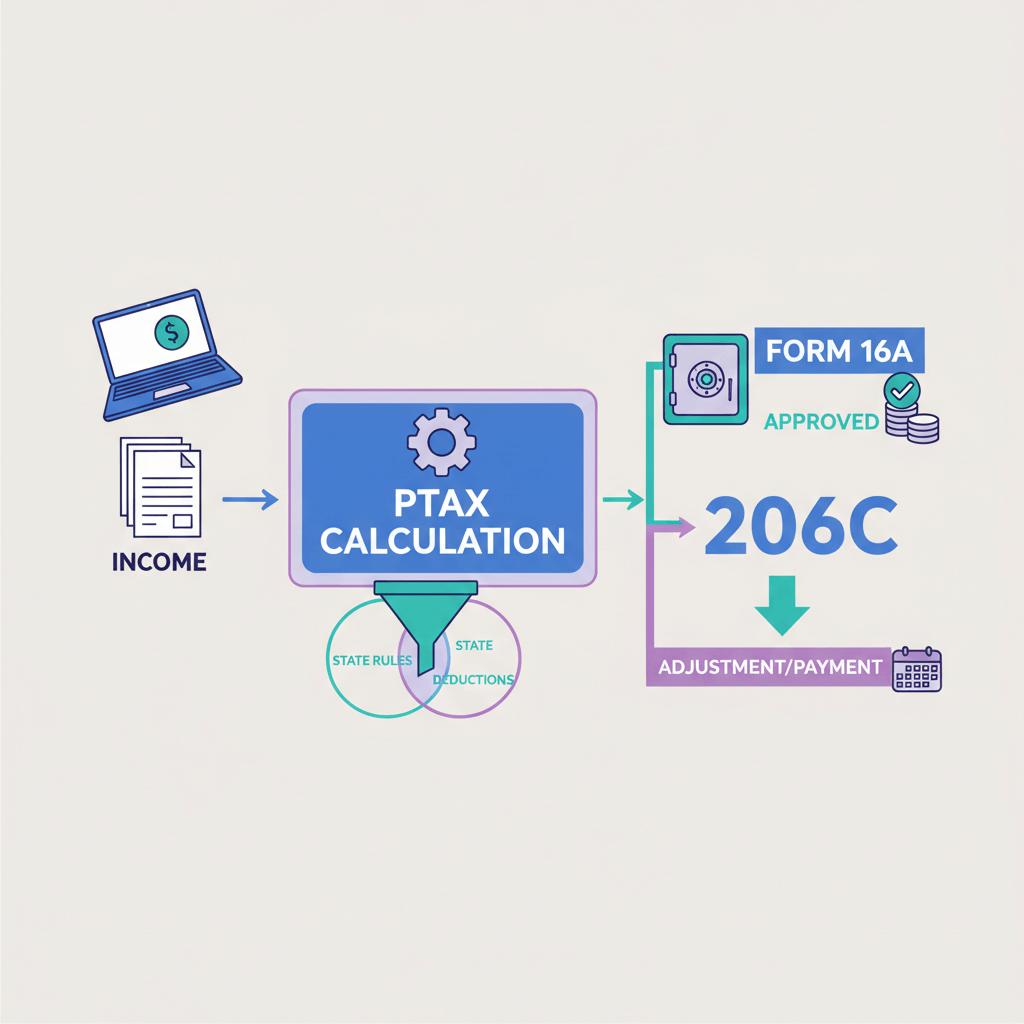

If you decide to convert the international incoming money from USD into INR for easier access, banks or fintechs typically charge a variable cost of 2-3% of the transaction volume. Along with this Karbon, provides a free FIRC/FIRA, unlike banks that may charge additional fees for these documents.

#5 What types of fees fall under International Incoming Wire Fees?

When it comes to receiving inward remittances in Indian banks, various types of charges may apply:

- Conversion Fees: These fees are incurred when converting foreign currency into Indian Rupees (INR).

- Wire Transfer Fees: Charges associated with the electronic transfer of funds from a foreign bank to an Indian bank.

- Service Charges: General fees covering the handling and processing of the inward remittance transaction.

- Correspondent Bank Fees: Additional charges may apply if intermediary or correspondent banks are involved in facilitating the transfer.

- Exchange Rate Markup: Banks may introduce a margin to the foreign exchange rate, resulting in additional costs due to the difference between the market rate and the bank's rate.

- Goods and Services Tax (GST): Certain banking services related to remittances may be subject to applicable taxes, such as GST. It is essential to be aware of potential tax implications.

#6 How to Avoid International Incoming Wire Fee?

- Choose a bank with wire transfer fee waivers included in the account package.

- Consider alternative payment methods, such as fintechs like Karbon, which are often more cost-effective than banks.

- Opt for online payment arrangements instead of in-person transactions at a bank branch for a generally more economical approach.

- Explore specialized peer-to-peer payment options for additional choices.

- Recognize that your regular bank is not the sole provider available.

#7 Are There Any Cheaper Ways to Recieve Money?

Banks and wire transfers are the most familiar ways to send and receive money internationally but they are not the most efficient. Many banks use outdated technologies which can increase both the time taken and money charged. Cheaper alternates exist like Wise or Western Union or Karbon Forex.

Karbon Forex

As a CEO, for your business, you will need to focus on the efficiency of international payments.

Karbon Forex's international transfer services for seamless and cost-effective money transfers worldwide. Register online or through the app to enjoy immediate quotes and send payments to over 80 countries.

Opt for payment in dollars via wire transfer witnessing the smooth deposit of funds into your recipient's overseas account in over 50 currencies facilitated by our partner bank J.P Morgan.

For businesses involved in frequent international transactions, consider the Karbon Forex Account, streamlining financial activities by holding, sending, spending, and receiving payments in various currencies.

Detailed Breakdown of International Incoming Wire Transfer Fees

Understanding the fees associated with international incoming wire transfers can help you save money. Here’s a breakdown of common fees and their average costs:

FAQs on international incoming wire transfer fees

Addressing frequently asked questions regarding international wire transfer fees is essential before settling on your business forex solution.

Which bank offers the lowest fees for international incoming wire transfers?

In the case of domestic transfers, ICICI provides complimentary wire services to eligible customers, while RBI imposes a relatively modest fee per payment. For international transfers, Karbon Forex provides the cheapest rates in the market, eliminating FIRA/FIRC fees for certain online foreign currency transactions.

Can banks waive international incoming wire transfer fees?

Some banks may or may not exempt priority customers, like those with private banking packages, from wire fees. Generally, standard account holders may not benefit from waived wire fees, but it's worth inquiring at your local branch, especially if you are a longstanding customer.

Does the recipient pay international incoming wire transfer fees?

Numerous banks in India impose incoming wire fees, deducted upon deposit into the recipient's account. The fees borne by the recipient depend on the transfer type and the particulars of their account.

Are there international incoming wire transfer fee differences for online vs in-person transfers?

Banks often have fixed fees for online wire transfers as opposed to in-branch setups. Typically, online and mobile banking services are associated with lower costs. Refer to your bank's fee schedule to see if this applies to your transaction.

Can you make free wire transfers?

No. Generally, an international incoming wire fee is charged. Nevertheless, opting for a specialized service rather than your regular bank may offer opportunities to minimize this cost.

Can you avoid international incoming wire fees?

Review the terms and conditions of your account to ascertain if there is a fee associated with receiving incoming wire payments; many specialized bank accounts have no wire transfer fee.

Bottom Line

Ultimately, international incoming wire fees will differ depending on the transaction volume, method of currency conversion, and type of service provider. Banks typically impose higher fees compared to alternative financial providers such as Karbon.

Explore the option of opening a specialized account with a provider like Karbon Forex that allows you to receive international money transfers in India with free FIRA and FIRC documents.

Though sending and receiving international money naturally involves higher costs, you may need to dig deep to find cheaper solutions to accept international payments in India.