Avoid delays and rejections. Karbon ensures every foreign payment meets RBI norms, with ultra-low FX markups.

Form A2 for outward remittance is a vital document that enables you to send money outside India.

This is a mandatory form that needs to be filled out by businesses hoping to make a wire transfer or any other type of large international business payment.

But what is form A2 for outward remittance?

Let’s find out!

What is the meaning of a remittance form?

A remittance form is a document designed to streamline the process of transferring money from one party to another. It typically includes essential details such as the sender's name, address, contact information, and the amount of money being sent. Additionally, it may contain pertinent information about the recipient, including their name, address, and account details if the remittance is destined for a bank account.

Remittance forms find utility across various scenarios, including:

International Money Transfers: When individuals or businesses send money abroad, they often need to complete a remittance form provided by their bank or money transfer service. This form ensures accuracy and efficiency in the transfer process.

Bill Payments: In certain instances, a remittance form accompanies payments for bills or invoices. It serves as a record of the payment and helps ensure proper application to the recipient's account.

Payroll Processing: Employers may utilize remittance forms to disburse wages or salaries to their employees. These forms specify the payment amount and provide the necessary details for direct deposit into the employee's bank account.

Government Disbursements: Government agencies may employ remittance forms to distribute benefits or payments to individuals or organizations. These forms aid in accurate delivery of payments and proper accounting.

What is the Form A2 application for outward remittance abroad?

Form A2 is a prescribed document by the Reserve Bank of India (RBI) utilized for conducting outward remittances abroad from India. It serves as an application form necessary for various foreign exchange transactions, including sending money overseas for purposes such as education, medical treatment, travel, or investments.

Key components of the Form A2 application typically include:

Personal or Business Details: Applicants are required to furnish personal information such as name, address, contact details, and passport number (for individuals), or business information like name, address, and registration number (for businesses).

Purpose of Remittance: The form mandates specifying the reason behind the remittance, such as education expenses, medical treatment abroad, travel costs, investments in foreign securities, or payments for imports.

Amount and Currency: Applicants need to indicate the remittance amount and the currency in which the transaction will occur.

Declaration and Authorization: A declaration section is included where the applicant affirms the accuracy of the provided information. Additionally, the form may require the signature of the applicant or an authorized representative.

Supporting Documentation: Depending on the purpose of the remittance, applicants may need to attach supporting documents such as invoices, proof of admission from a foreign university (for educational expenses), or medical treatment certificates.

What are A1 and A2 remittances?

In the context of foreign exchange transactions in India, A1 and A2 remittances refer to two categories of outward remittances.

- A1 Remittances: A1 remittances are transactions where the purpose of the remittance falls under the purview of the Liberalized Remittance Scheme (LRS) established by the Reserve Bank of India (RBI). Under the LRS, individuals resident in India are allowed to remit money abroad for various permissible purposes, such as travel, education, medical treatment, investment in foreign securities, or maintenance of relatives. A1 remittances typically involve smaller amounts of money and can be made without seeking specific approval from the RBI.

- A2 Remittances: A2 remittances, on the other hand, are transactions that do not fall under the scope of the Liberalized Remittance Scheme (LRS) or exceed the limits set under the scheme. These transactions require prior approval from the RBI or specific regulatory authorities. Examples of A2 remittances include payments for imports, investments in overseas businesses, or remittances for activities not covered by the LRS. A2 remittances may involve larger amounts of money and require additional documentation and scrutiny before approval.

What is the purpose of A2 form for business outward remittance from India?

The A2 form for business outward remittance from India serves the purpose of enabling and regulating the transfer of funds overseas for various business needs. Businesses based in India often require outbound remittances for a variety of purposes, including:

- Payment for imports: This involves transferring funds to foreign suppliers to procure goods or services from abroad.

- Investment abroad: Companies may utilize the A2 form to send funds overseas for investments such as acquiring assets, establishing subsidiaries, or participating in joint ventures.

- Overseas business operations: Indian businesses with international operations may need to transfer funds to their foreign branches or subsidiaries for various operational expenses, capital injections, or profit repatriation.

- Loan repayments: Companies may have borrowed funds from foreign lenders and need to remit payments abroad to settle these debts.

- Royalty or license fee payments: Businesses may have obligations to pay foreign entities for the use of intellectual property rights like patents, trademarks, or copyrights, and the A2 form facilitates such transactions.

What documents are required for A2 payment?

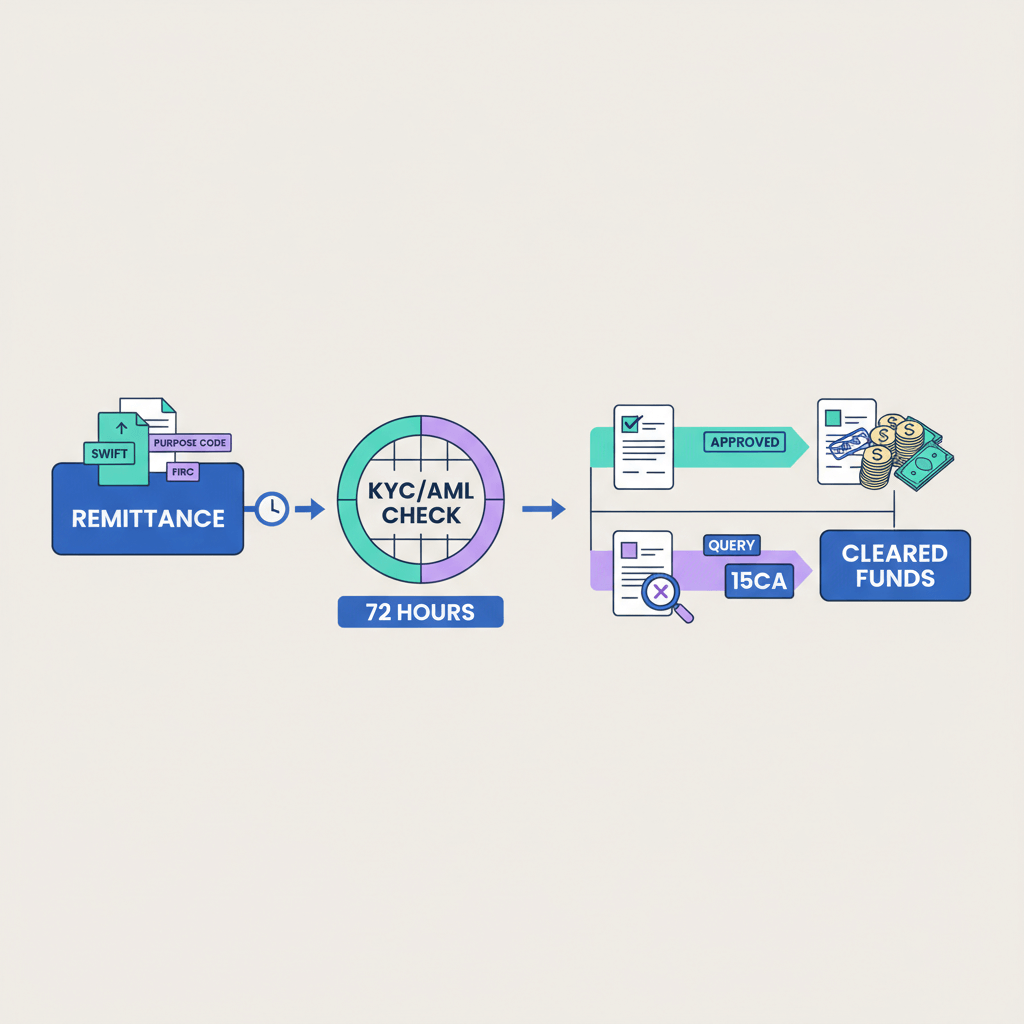

When conducting business payments through the A2 form, several documents are typically required to facilitate outward remittances from India:

- A2 Form: This form serves as the core document for initiating business-related outward remittances. It captures vital information such as the purpose of the payment, the amount to be transferred, and details of the beneficiary.

- KYC Documents: Essential for verifying the identity and address of the business entity, KYC documents may include the certificate of incorporation, memorandum and articles of association, PAN card of the company, and address proofs.

- Invoice or Contract: Providing invoices, contracts, or purchase orders is common practice to specify the transaction's nature, such as payments for goods, services, or intellectual property rights.

- Import Export Code (IEC): If the remittance pertains to trade activities, businesses are often required to furnish their Import Export Code issued by the Directorate General of Foreign Trade (DGFT).

- Bank Certificate: Some banks may request a certificate from the beneficiary's bank to confirm account details, ensuring accurate processing of the remittance.

- Tax Deduction Documents: When applicable, businesses must provide documents related to tax deduction at source (TDS), including TDS certificates, to comply with taxation regulations.

- Purpose Declaration: A declaration stating the purpose of the remittance is often required, particularly for specific categories like import payments, overseas investments, or licensing fees.

- Additional Supporting Documents: Depending on the transaction's nature, supplementary documents may be necessary. For instance, investment-related remittances may require documents related to the investment project or agreement.

How to fill outward remittance form?

Here is a sample image of the outward remittance form for businesses seeking to make international business payments from India.

.png)

.png)

Most banks will require a form like the above to be filled. Sections like remitter and beneficiary details are easy to understand, we’ll explain the more technical terms in the form-

AD code- This is the authorized bank code (provided by the RBI). The bank will fill it itself.

GSTN destination state name for the corresponding transaction - This refers to the GSTN number for the state, each Indian state has its own number. For example:

Destination GSTN number for the above-mentioned state - The GSTN number for the state in the format of a 15-digit alphanumeric code structured as follows:

Purpose code in Form A2 - Every outward remittance from India needs a purpose code, make sure to provide the correct one. Using the wrong purpose code in Form A2 may lead to your transaction being blocked.

Debit Instructions in Form A2 - The debit instructions in Form A2 include the bank account from where the money is to be debited along with who pays the foreign bank charges. You have 3 options OUR (remitter pays the charges), BEN (beneficiary pays the charges, and SHA (charges are shared).

Forex hedging in form A2 - Banks will allow you to take advantage of any FX contracts you have to get beneficial currency exchange rates.

FEMA declaration - Declare that the remittance adheres to the Foreign Exchange Management Act (FEMA) guidelines and is for permissible purposes.

That’s all. After filling all sections correctly, sign the form and submit it to the bank.

What Is “Ultimate Country Name” in SBI Forms?

When filling out Form A2 for the State Bank of India (SBI), you may encounter the term "Ultimate Country Name." This field is crucial for specifying the final destination of funds in cross-border transactions, especially under RBI guidelines.

Ultimate Country Name SBI: Meaning

The ultimate country name refers to the country where the remittance or transaction will be finalized. It is typically the recipient's location, irrespective of intermediary banks or transit countries. For example, if you are sending money to someone in Germany but the transaction routes through a bank in the USA, the ultimate country name is "Germany."

FAQs

Is Form A2 mandatory for international business payments?

Yes, Form A2 is required for specific transactions under the Foreign Exchange Management Act (FEMA) regulations in India. It's used for outward remittances from India for purposes like travel, education, business payments, and investments abroad.

Who should file Form A2?

When Indian businesses send money abroad to pay international vendors for things like buying goods or services, they have to fill out a form called Form A2. This form is submitted to a special bank authorized by the Reserve Bank of India. It's like an official paper that says why the money is being sent, how much is being sent, who it's going to, and sometimes, they need to include other papers too. By doing this, businesses follow the rules set by the government and make sure they're sending money overseas in the right way for their business needs.

What is the declaration for outward remittance?

The declaration for sending money abroad involves giving details about why the money is being sent, how much is being sent, and who will receive it. This is usually done through a form or online platform provided by the bank or financial institution handling the transfer. You have to explain why you're sending the money, how much you're sending in your local currency and the currency of the recipient's country, provide the recipient's name, address, and bank account details, and state where the money came from. It's important to follow the rules and regulations set by the government to make sure the transfer is legal and legitimate. This helps prevent illegal activities like money laundering and terrorism financing while making sure the transfer is for valid reasons like business, education, or personal needs.